Bookmark This Page

| Friday's ETF with Unusual Volume: RSPU

Fri, 03 May 16:24:07 GMT |

| S&P 500 Analyst Moves: CTRA

Fri, 03 May 16:12:25 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

Highlights:

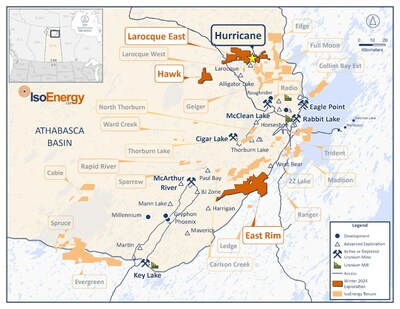

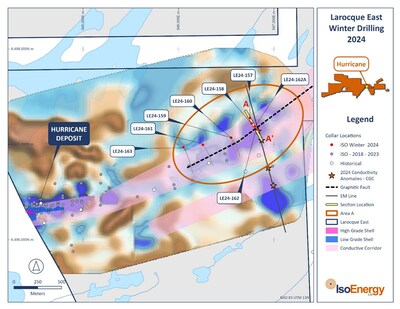

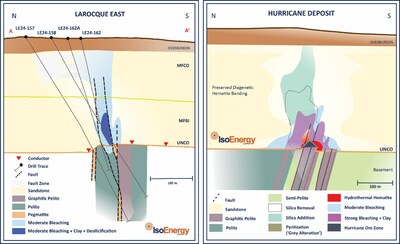

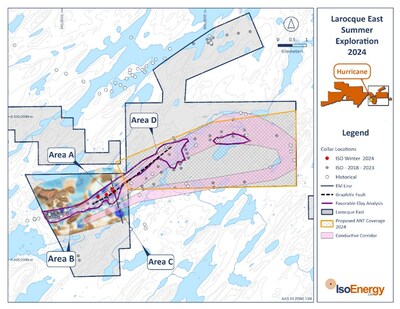

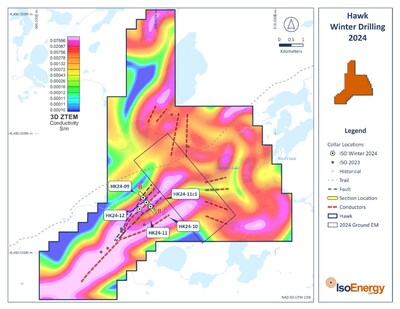

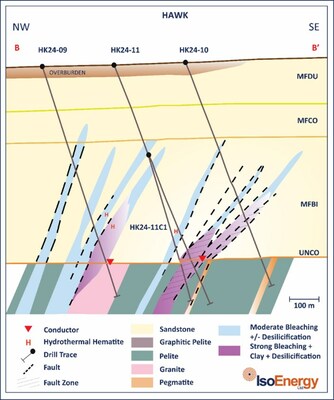

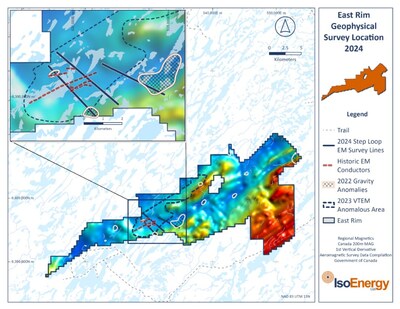

Phil Williams, Chief Executive Officer, commented "We are strongly encouraged by the results from our first drill testing of the ANT anomalies identified at the Laroque East and Hawk projects. In both cases, drilling proved that the ANT surveys correctly show alteration, a prerequisite for mineralization, and will serve as an important targeting tool going forward. At Laroque East, our drilling focused on a large ANT anomaly (Area A) located almost 2km to the east of the Hurricane deposit. This drilling intersected similar faulting and alteration to that seen at Hurricane, which we believe indicates we are in a fertile environment for mineralization. Encouraged by this relatively limited drill testing, we are planning an expanded summer drill program, starting in June, at Laroque East covering Area A as well as three additional Areas (B, C and D). The work at Hawk confirmed our view that a very large exploration target exists, and we are in the early stages of exploring the 12 km prospective corridor." Winter Exploration Update Hurricane, Larocque East Project Early in the winter program, a single line of stepwise moving loop time domain ground EM was completed at Larocque East to aid in drill targeting in Target Area A (Figure 1 & Figure 2). Two conductors that correspond to the historic conductor trends were confirmed and a third conductor within the ANT Area A anomaly was identified north of the other two conductors. Subsequent drilling demonstrated the source of this third, northern response to be graphitic-pyritic pelitic gneiss and faults typical of those that underlie the Hurricane deposit and thus expanded the drill proven width of the prospective Hurricane corridor to 300m. The EM survey also established a new conductive response that corresponds to an ANT low velocity zone approximately 450m south of the main Hurricane trend. 3,364m of drilling at Area A targeted a velocity low highlighted by ANT survey completed in summer 2023 (Figure 2). In summary, the exploration drilling successfully intersected alteration and significant late brittle structures both in the sandstone and the basement (Figure 3). Graphitic brittle faults, structurally disrupted and desilicified sandstone, unconformity topography changes, and clay and hydrothermal hematite alteration intersected in the winter drill holes are all features observed at the Hurricane deposit. This new extension to the prospective corridor that hosts the Hurricane deposit has been drill-defined over an 800m strike length and is open to the east. The winter 2024 results have significantly upgraded Target Area A at Larocque East and further drilling is planned for the 2024 summer. The first hole of the winter campaign, LE24-157 intersected a brittle fault 157m below the unconformity along the northwest contact of a strongly graphitic and pyritic pelite interval (Figure 3), typical of the Hurricane deposit 1,500m to the west-southwest. Basal sandstone clay results for this hole indicate a mix of illite, kaolinite and chlorite. Drill Hole LE24-158 followed-up LE24-157 on section to test the unconformity projection of the brittle graphitic fault. Strong bleaching, desilicification and fault-controlled clay were intersected below 248m. Spectral analysis of fault zone mineralogy indicates strong illite and chlorite. Drilling identified an unconformity offset of 18m over a lateral distance of 58m between holes LE24-157 and LE24-158. LE24-162 was drilled to test the unconformity offset between drill hole LE24-157 and LE24-158. LE24-162 was abandoned at 167m in strongly desilicified zone and restarted as LE24-162A. LE24-162A intersected a broad zone of bleaching below 213m and moderate structural controlled desilicification from 248 to unconformity at 267.2m. Drill hole LE24-162A has confirmed the unconformity elevation change with 17m unconformity offset over 20m between LE24-157 and LE24-162A on section. Drill hole LE24-159 and LE24-160 tested the ANT anomaly on a section 200m west of LE24-157 (Figure 2). Both holes intersected a significant graphitic-pyritic pelite interval like the holes on the section to the east. LE24-159 intersected a fault zone and moderate desilicification from 167 to 173m in the sandstone. LE24-160 tested 74m to the north of LE24-159 and intersected a strong brittle fault zone hosted in graphitic-pyritic pelites from 349.5 to 379.9m downhole that is the downdip extension of the sandstone-hosted fault in LE24-159. LE24-161 was planned as a further 200m further step-out along strike to the west-southwest (Figure 2). Drilling intersected strong bleaching and moderate clay alteration from 227 to 290m followed by secondary hematite above the unconformity. Moderate clay and chlorite alteration was intersected immediately below the unconformity. Brittle graphitic faults were intersected between 347 and 353m, and at 399m, 406m, and 439.7m downhole. LE24-163, the last drill hole of the winter program, was drilled 200m west of LE24-161 (Figure 2) and it successfully intersected the basement hosted graphitic and pyritic brittle fault at 387.5m and 509.7m. Additional ANT surveys and diamond drilling are planned at Larocque East during the summer program (Figure 4). The ANT surveys are expected to cover the eastern extension of the highly prospective Hurricane conductor corridor and data acquisition will begin in Area D immediately east of the winter drilling where prospective clay mineralogy and structure are recorded in historic diamond drill holes. Drilling is being planned to follow-up encouraging winter results in Area A, and will also target areas B, C and D. Drilling plans for Area D are expected to evolve as velocity models are interpreted from newly acquired ANT data. Hawk Project Drilling at Hawk (Figure 1) totalled 3,863m and tested targets derived from the 2023 ANT and ground EM surveys along the structural corridor identified at Hawk in 2023. The winter drill program consisted of four drill holes collared from surface and one hole wedged off a parent hole. An additional 24.0 line-kilometres of fixed loop SQUID ground electromagnetic surveying were completed to extend detailed EM coverage along the Hawk structural corridor (Figure 5). Profiles were collected on four lines spaced 400m apart. The survey was completed in late March. Results are currently being interpreted and will be factored into the summer drill hole planning. Holes HK24-09, HK24-10, HK24-11, and HK24-11c1 were drilled on section to test for mineralization, structure, and alteration coincident with overlapping strong EM conductivity anomalies and a significant low-density zone identified by the 2023 ANT survey. All four holes successfully intersected structure, alteration, and broad zones of elevated radioactivity typical of unconformity-related uranium deposits (Figure 6). HK24-09 intersected a zone of intense brecciation, faulting, and silica removal from 345 to 365m. HK24-10 intersected repeating zones of clay- and silica-altered faults in the sandstone from 450 to 570m. HK24-11 intersected metre-scale zones of structurally controlled white clay replacement in the sandstone from 678m to the unconformity at 709.3m. The upper basement of HK24-11 is strongly clay-altered and is underlain by a mixed package of metasedimentary rocks. Anomalous radioactivity averaging 695 counts per second was detected via Mt. Sopris 2PGA downhole gamma probe over 2.3m in a clay-altered zone directly underlying the unconformity in HK24-11. Wedge hole HK24-11c1 intersected a similar sequence of intense clay alteration in the lower sandstone and upper basement, underlain by altered pelitic gneisses. HK24-12 was a step-out 400m southwest along strike of the HK24-12 unconformity intercept and targeted a strong EM conductor between HK23-08 and HK24-11. HK24-12 intersected broad zones of brittle structure, clay alteration, and moderate bleaching in the sandstone from 390m to the unconformity at 692.1m. Strong clay alteration within a fault gouge directly at the unconformity averages 1,200 counts per second via Mt. Sopris 2PGA gamma probe. Several units of faulted graphitic gneiss were intersected between 741 and 822m downhole. The 2024 winter drill program at Hawk successfully intersected and extended the structural corridor identified in the 2023 Hawk drill programs, with highly prospective structure and alteration identified along a corridor exceeding two kilometres in length. Follow-up drilling along this corridor is planned for summer 2024. East Rim Project A total of 81.2 line-kilometres of step loop transient EM surveying, was done along three profiles on the early-stage East Rim project. The project is situated 45 kilometres east-southeast of the McArthur River mine in the southeastern portion of the Athabasca Basin (Figure 1). Target depths are relatively shallow as sandstone thickness ranges between 0 and 260 metres. The three EM profiles were surveyed in an area of interest where strong conductivity mapped by 2023 VTEM survey, density lows mapped by 2022 Falcon gravity surveys, and brittle structure and clay alteration logged in historic diamond drill holes all occur within an underexplored magnetic low corridor (Figure 7). The survey was finished in early April and interpretation of results is in progress. Helicopter-supported drilling is planned for the summer. ANT surveys are also being considered to map favourable structural corridors on the property. Other Projects Additional work is being planned for the summer of 2024 to develop a pipeline of exploration targets on the Company's earlier stage projects, including helicopter and drone radiometric and magnetic surveys, and ground ANT surveys on the Cable, Evergreen, Rapid River, 2Z and Madison projects. Surveys on additional projects are being considered. Corporate Update Under the terms of the option agreement between the Company and Mega Uranium Ltd. ("Mega") dated May 14, 2020, as amended (the "Option Agreement"), pursuant to which the Company acquired the Ben Lomond project in Australia, Mega is entitled to receive certain payments contingent upon the attainment of certain milestones tied to the spot price of uranium. As the Ux U3O8 Monthly Average Price exceeded USD$100/lb (the "Pricing Threshold"), Mega is entitled to receive payment of an additional $1,050,000. As a result of the Pricing Threshold having been met, the Company delivered aggregate consideration to Mega of $1,050,000 comprised of $525,001.72 in cash and the balance satisfied by the issuance of 125,274 common shares of the Company ("Common Shares") at a deemed price of $4.1908 per share, being the volume-weighted average price of the Common Shares for the five-day period ending on February 23, 2024, being the day on which the Pricing Threshold was achieved. Following this payment, no further payments are owing to Mega pursuing to the Option Agreement. All Common Shares issued pursuant to the Option Agreement are subject to final approval of the TSX Venture Exchange (the "TSXV") and will be subject to a hold period expiring four months and one day from the applicable date of issuance. Qualified Person Statement The scientific and technical information contained in this news release was reviewed and approved by Darryl Clark, P.Geo., IsoEnergy's Vice President, Exploration and Development, who is a "Qualified Person" (as defined in NI 43-101 - Standards of Disclosure for Mineral Projects). Dr. Clark has verified the data disclosed. For additional information regarding the Company's Larocque East Project, including its verification and quality assurance and quality control procedures applied to the exploration work described in this news release, please see the Technical Report titled "Technical Report on the Larocque East Project, Northern Saskatchewan, Canada" dated August 4, 2022, on the Company's profile at www.sedarplus.ca. About IsoEnergy Ltd. IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S., Australia, and Argentina at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada's Athabasca Basin, which is home to the Hurricane deposit, boasting the world's highest grade Indicated uranium Mineral Resource. IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer. Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Forward-Looking Information The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, anticipated results of the winters 2024 drill program and planned exploration activities for summer 2024. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate. Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to the Company set out in the Company's filings with the Canadian securities regulators and available under IsoEnergy's profile on SEDAR+ at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE IsoEnergy Ltd.

| ||||||||||||||||||||||||||||||||||||||||||||||||||