Bookmark This Page

| Friday's ETF with Unusual Volume: RSPU

Fri, 03 May 16:24:07 GMT |

| S&P 500 Analyst Moves: CTRA

Fri, 03 May 16:12:25 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

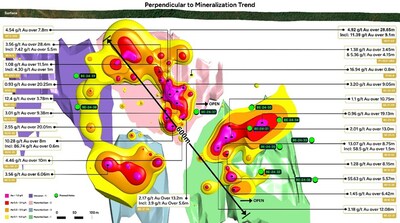

LONDON, ON, April 23, 2024 /CNW/ - Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) ("Abitibi" or the "Company") is pleased to announce that it has successfully completed its Phase 1 maiden drill program at the B26 Polymetallic Deposit ("B26", the "Project" or the "Deposit"). On November 16th, 2023, the Company entered into an option agreement on the B26 Polymetallic Deposit to earn 80% over 7 years from SOQUEM Inc. ("SOQUEM"), a subsidiary of Investissement Québec (see news release dated November 16, 2023). 44 diamond drill holes were completed totalling 13,502 metres under the first phase of a fully funded 50,000‑metre, 2024-2025 drill program. To-date, assay results from the first 10 holes have been released; assay results for the remaining 34 drill holes are expected over the coming weeks and will be released once received and compiled. The Company intends to recommence drilling activities in early June once the winter break-up concludes and Phase 2 targeting is finalized. Highlights from the Phase 1 Program include:

Jonathon Deluce, CEO of Abitibi Metals, commented, "We are thrilled with these initial results of our maiden drill program at the B26 Polymetallic Copper Deposit. We had initially planned to drill 2,750 metres but with the continued success in drilling and support from our shareholders, we expanded our maiden program to 13,500 metres, larger than our initial total program for 2024." Mr. Deluce continued: "The significance of this program cannot be understated. Part of our thesis when we optioned B26 was to assess the potential open-pit component that could be added to the historical underground resource. Our strategy for this maiden program was to primarily concentrate on high-priority targets within the Main Deposit to a depth of 300 metres, and the results from #293, #294, #300 and #301, which identified significant near-surface high metal factor zones, support our thesis of assessing the open-pit potential at B26 further. With the recently completed financing bringing our total treasury to approximately $19 million, we are well-positioned to build on this maiden program with a further 36,500 metres to be drilled into 2025. I look forward to sharing the remaining results in the coming weeks as we prepare for the next phase of drilling in the Spring of 2024." The Company's 2024 strategy moving forward to develop B26 will be focused on five milestones:

Beschefer Drilling Update: The Company is pleased to announce that drilling continues at the Beschefer Gold Project 7 km to the northeast of the B26 Deposit. To date, the Company has focused drilling on the "East Zone", where 5 holes totalling 1,679 metres have been completed as of April 22, 2024 and is on track to complete 2,975 metres across 10 holes. The East Zone hosts some of the highest historical intercepts, including 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres. B26 Polymetallic Deposit Summary Located within the prolific Abitibi Greenstone Belt, B26 comprises 66 claims covering 3,328 hectares in the Eeyou Istchee Baie-James territory and represents a substantial opportunity to develop a copper, zinc, gold, and silver Polymetallic Deposit in a region with a rich history of base and precious metal production, which includes the Detour and Casa Berardi Mines. There is year-round road access with a power line running through the Project. Abitibi is the first public company with the option to earn into the B26 Deposit, which has a strike length of 1 km and depth extent of 0.8 km, both of which are open to expansion. Abitibi will focus on delivering shareholder value with an aggressive exploration approach, including a fully financed approximate 50,000 metres of drilling in 2024 and 2025 that will focus on advancing the historical 2018 resource1 while testing its open-pit potential. Property Highlights Include:

Qualified Person Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release. About Abitibi Metals Corp: Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi's portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a historical resource estimate1 of 7.0MT @ 2.94% Cu Eq (Ind) & 4.4MT @ 2.97% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modelled zones. About SOQUEM: SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec's mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future. ON BEHALF OF THE BOARD Jonathon Deluce, Chief Executive Officer The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements: Twitter: https://twitter.com/AbitibiMetals LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/ Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statement: This news release contains certain statements, which may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company's behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi's forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects," "estimates," "anticipates," or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results "may," "could," "might" or "occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations. SOURCE Abitibi Metals Corp.

| |||||||||||||||||||||||||||||||||||||||||||||||||||