Bookmark This Page

| Daily Dividend Report: PH, SYY, XOM, CVX, BAC

Fri, 26 Apr 16:24:29 GMT |

| Daily Dividend Report: PFE, SCHW, CI, MPC, AVY

Thu, 25 Apr 17:45:00 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

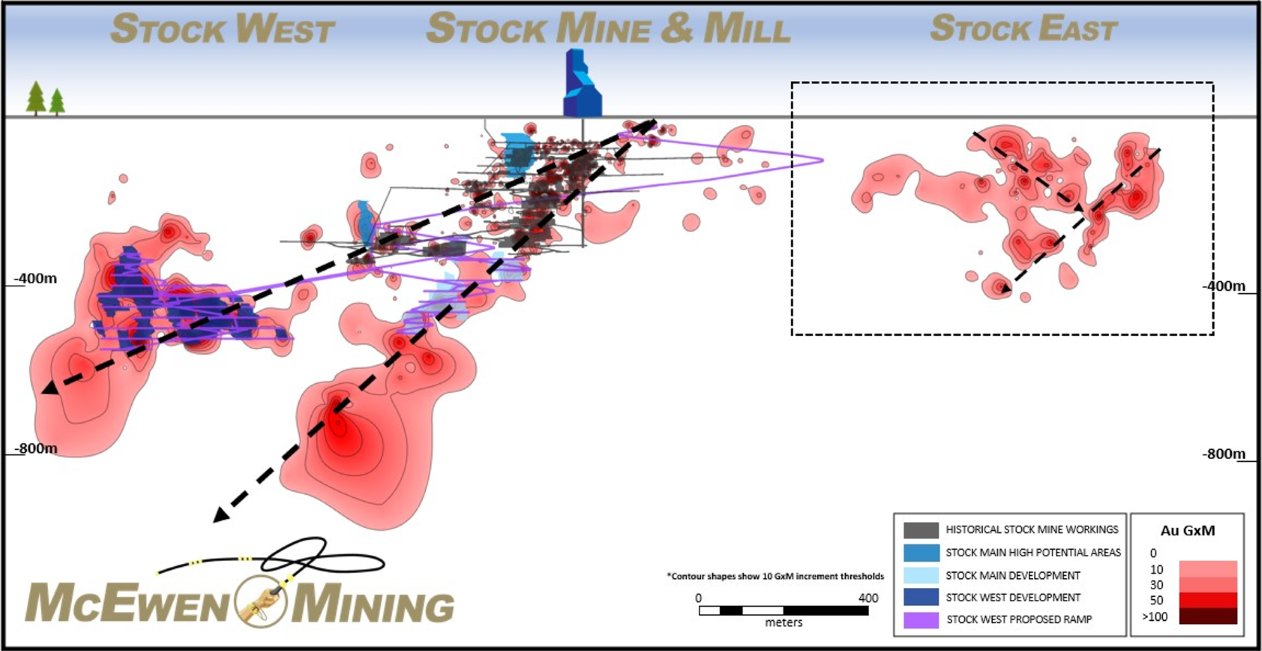

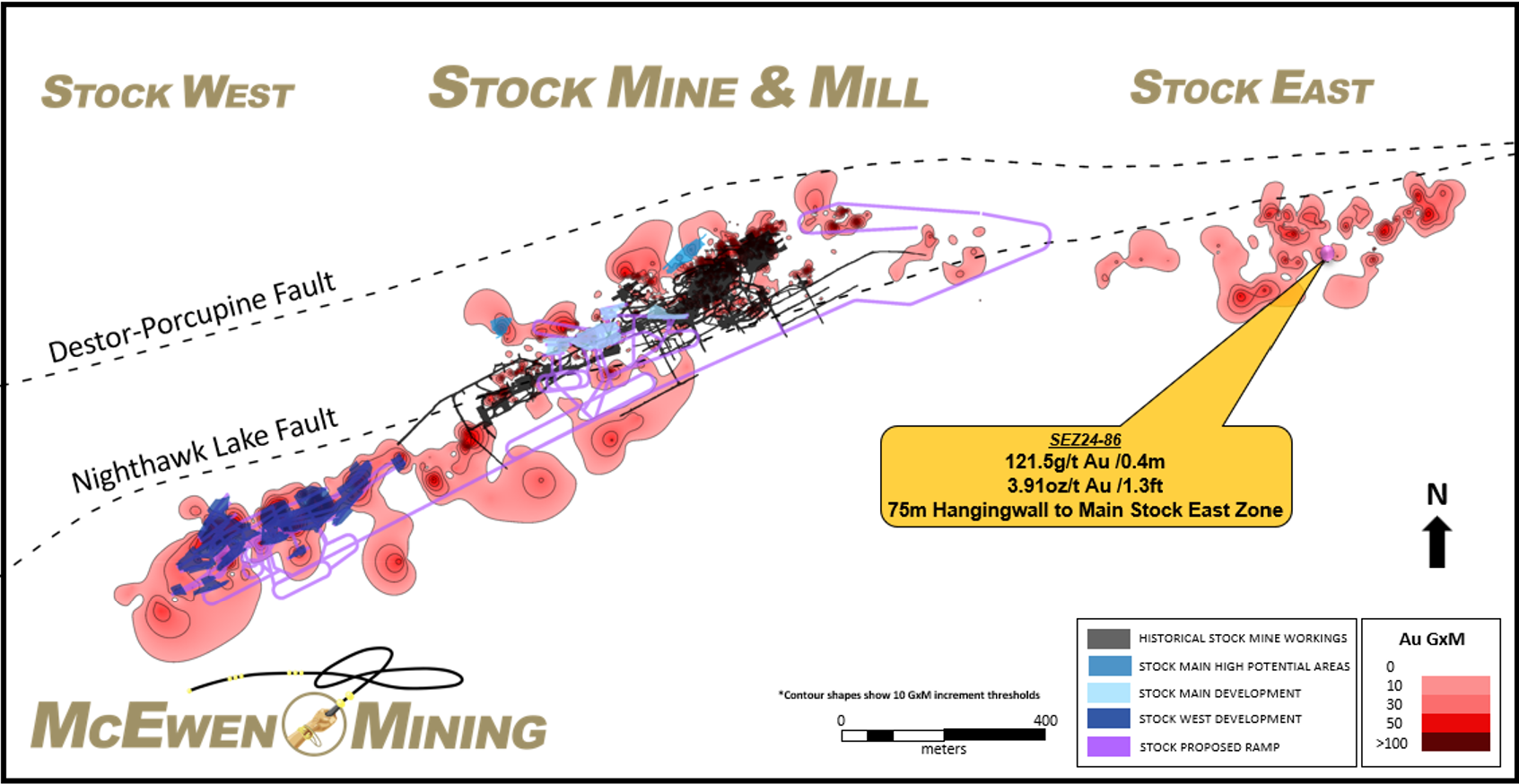

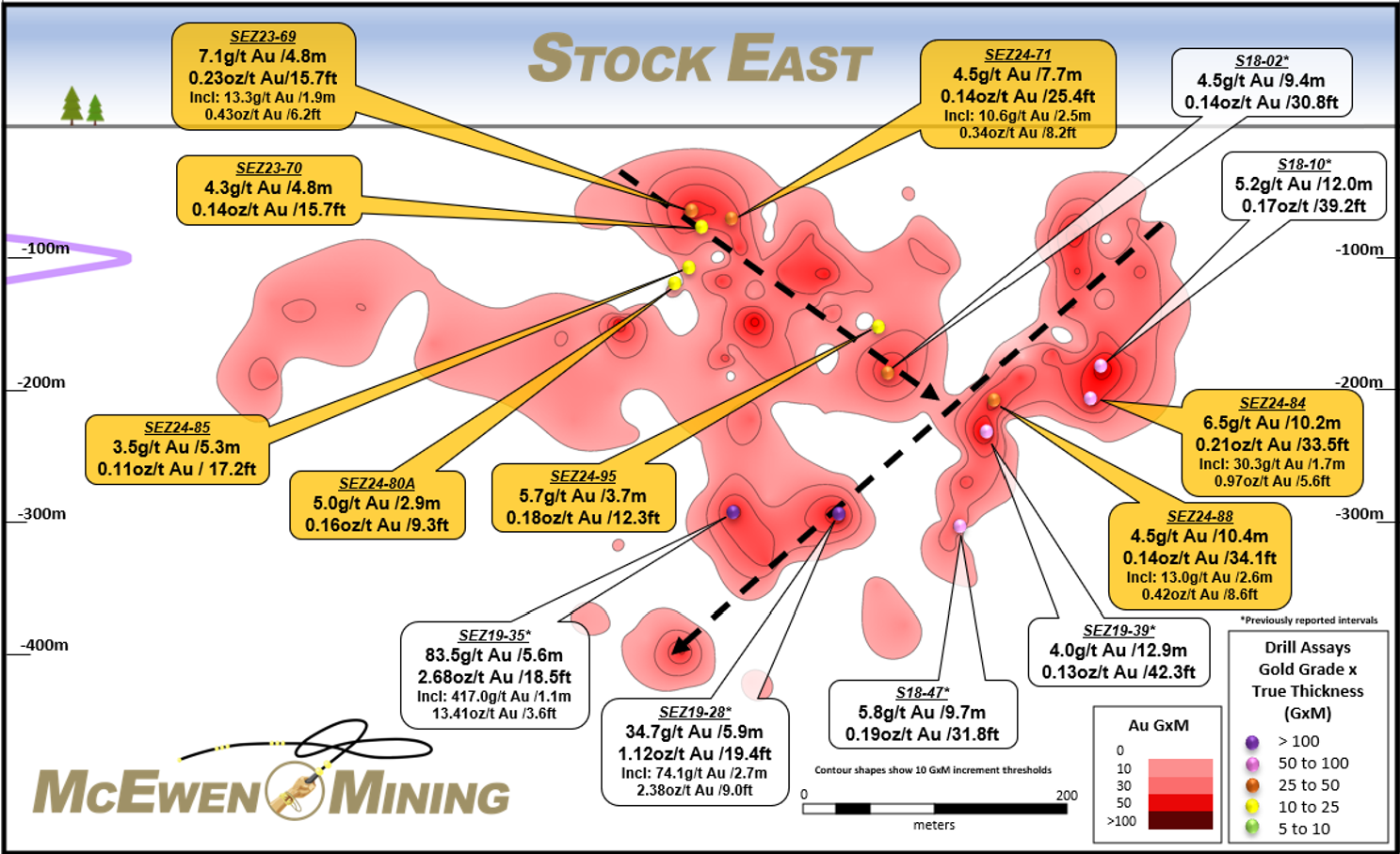

McEwen Mining: Stock Exploration UpdateAggressive Exploration Generating a Bright Future at StockStock West and Stock Main gold resources increase by 31%, mineralization continuing at depth; TORONTO, Feb. 28, 2024 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX.CA) is pleased to report on three outcomes of its large exploration investment at the Stock Mine property, part of the Fox Complex, in the prolific Timmins gold district of Northern Ontario, Canada: One, a 31% year over year increase of gold resources at Stock West and Stock Main (historical Stock Mine), with Two, confirmation of good grading structures plunging to depth; and Three, Stock East emerging as a potential new near-term source of future revenue. 31% Resource Growth (Inferred + Indicated) and the Importance of Structures at Stock West and Main Geological interpretations suggest that two principal structures that plunge to depth, emanating from the historical Stock Mine (see Fig. 1) control the mineralization of Stock West and Stock Main. Resources identified within these structures in 2023 account for most of the 31% increase in the Stock West and Main resource (see Table 2) when compared to year end 2022. The infill drilling at Stock West completed in 2023 demonstrated an increase in the widths of the mineralized zones with a slight decrease in the overall grade. Drilling along the deeper part of structures accounts for about half of the 31% increase in the updated resource estimate and demonstrates the potential for these structures to extend to depth and remain highly prospective for additional exploration and resource growth. Stock East Emerging Drilling in late 2023 and continuing into 2024 was designed to assess Stock East's potential to be a shallow source of near-term revenue during the construction phase of the access ramp at Stock West. Assay results from the infill drill program successfully identified mineable widths and grades. In addition, the block model updated in 2022 has been successful in forecasting the projected grades and widths for the new drilling. Stock East mineralization appears to be controlled by two plunge directions, with one similar to that seen for the rest of Stock structures (see Fig. 1 in upper right-hand corner and Fig. 3) An assay result from drillhole SEZ24-86 that returned 121.5 grams per tonne (g/t) gold (Au) over 0.4 meters (m), equivalent to 3.91 ounces per tonne (oz/t) Au over 1.3 ft (see Fig. 2), is very intriguing because of its high grade, proximity to surface and position outside the main mineralized zone (lying approximately 75 m in the hanging wall to the main Stock East zone). Its orientation suggests that earlier drilling may have missed other possible high-grade occurrences. To date, all of the drilling at Stock East has been in a mostly North to North-West orientation, therefore this particular intercept may have been mostly missed. Additional follow-up drilling is warranted to determine its true geometry. Some of the key drill results from our recent drilling programs are listed below; see Fig. 3: Also shown in Fig. 3 are earlier assay values of attractive grades and widths.

The location of Stock East is strategic for multiple reasons: From a geological perspective: From an operational perspective: The current drilling program aims to upgrade the majority of the Inferred mineralization to the Indicated category while also targeting higher grade (>10 GxM, grade x true width) sections of the zone. We are also updating the resource for Stock East to include these new intercepts, targeting completion by the end of Q1 2024 (see Table 1).

Figure 2: Plan view of the mineralization seen on the Stock property

Figure 3: Longitudinal section looking North - Stock East Zone: 2023 & 2024 drill results shown in yellow

Most of the assay results from Stock East shown in Fig 3. represent true widths of over 4 m with good grades, and there is sound geological continuity between the drillholes. The outline of this zone is well defined and geological interpretations indicate a dip of about 70 degrees to the SE. Stock East has a strike length of approximately 400 meters, it extends vertically from near surface to a depth of at least 350 m and is open down-dip and to the East. The two proposed conjugate structural plunge directions (see Fig. 3, dashed lines) appear to be consistent with geological interpretations for the mineralization seen at Stock East and to provide excellent targeting vectors for future exploration and resource growth. Table 1: Highlights of recent drill intercepts received for the Stock East zone

This resource statement does not include the Stock East deposit, which had its own mineral resource estimation updated in March 2022; there is a separate Mineral Resource Statement for Stock East. Technical information Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., Chief Exploration Geologist, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects." The technical information related to resource and reserve estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining's Director of Resource Modelling and Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects." Exploration drill core samples at the Stock Complex were typically submitted as 1/2 core. Analyses reported herein were either performed by the fire assay method at the accredited laboratory Pangea Laboratorio in Sinaloa, Mexico, owned and operated by an indirect subsidiary of the Company (NMX-EC-17025-IMNC-2018, ISO /IEC 17025:2017), or by the photon assay method at the accredited laboratory MSA Labs in Timmins, Ontario, Canada (ISO 9001 & ISO 10725). For a list of drilling results at Stock since June 2, 2023, including hole location and alignment, click here: CAUTION CONCERNING FORWARD-LOOKING STATEMENTS The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc. ABOUT MCEWEN MINING McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced-stage Los Azules copper project in Argentina. Rob McEwen, Chairman and Chief Owner, has a personal investment in the company of US$220 million. His annual salary is US$1. Want News Fast?

A photo accompanying this announcement is available at:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||