Bookmark This Page

| Daily Dividend Report: CNQ,AIG,APH,UPS,ICE

Thu, 02 May 15:59:54 GMT |

| S&P 500 Movers: ETSY, HWM

Thu, 02 May 14:44:44 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

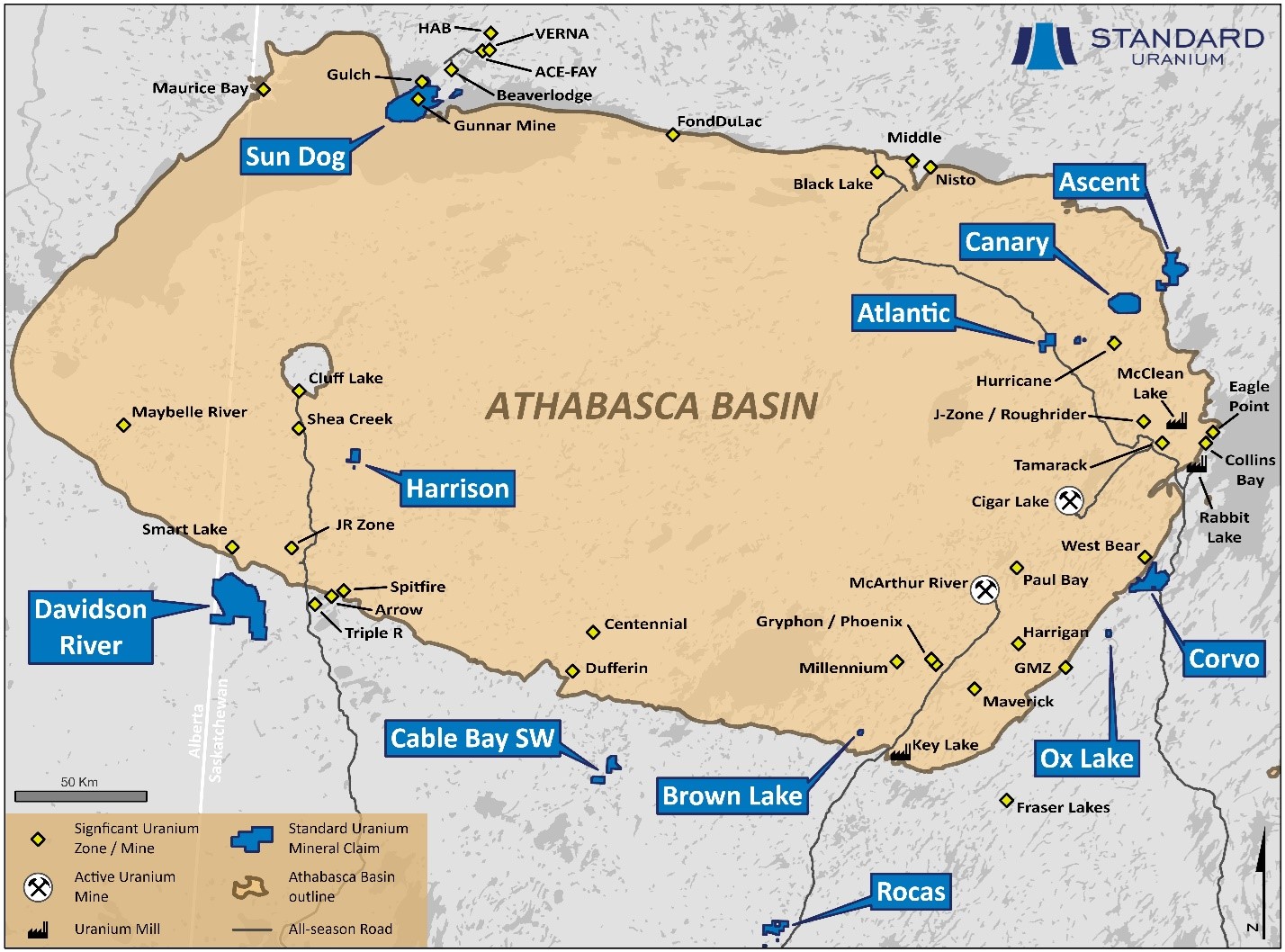

VANCOUVER, British Columbia, Feb. 09, 2024 (GLOBE NEWSWIRE) -- Standard Uranium Ltd. ("Standard Uranium" or the "Company") (TSX-V: STND) (OTCQB: STTDF) (Frankfurt: FWB:9SU) is pleased to announce the acquisition by staking of the Harrison uranium exploration project in the southwest Athabasca Basin region, northern Saskatchewan. Additionally, the Company has expanded the Ascent project by 3,728 hectares, effectively doubling the project size. With the addition of the Harrison project and expansion of the Ascent project (as described below), the Company now has ownership interests in eleven exploration properties, totalling over 209,867 acres across the uranium-rich Athabasca Basin (Figure 1). Key Highlights:

The Company considers uranium mineralization with concentrations greater than 1.0 wt% U3O8 to be "high-grade". "As we continue our low-cost staking efforts across the Basin, we aim to grow and diversify our portfolio of projects enabling Standard Uranium to drive forward with dedicated exploration and collaboration with other companies. Picking up another piece of promising land in the southwest uranium district adds good value to our land package, in addition to doubling the size of Ascent," said Sean Hillacre, President & VP Exploration for the Company. "We look forward to the transactional and exploration upside we can derive from these new claims in 2024."

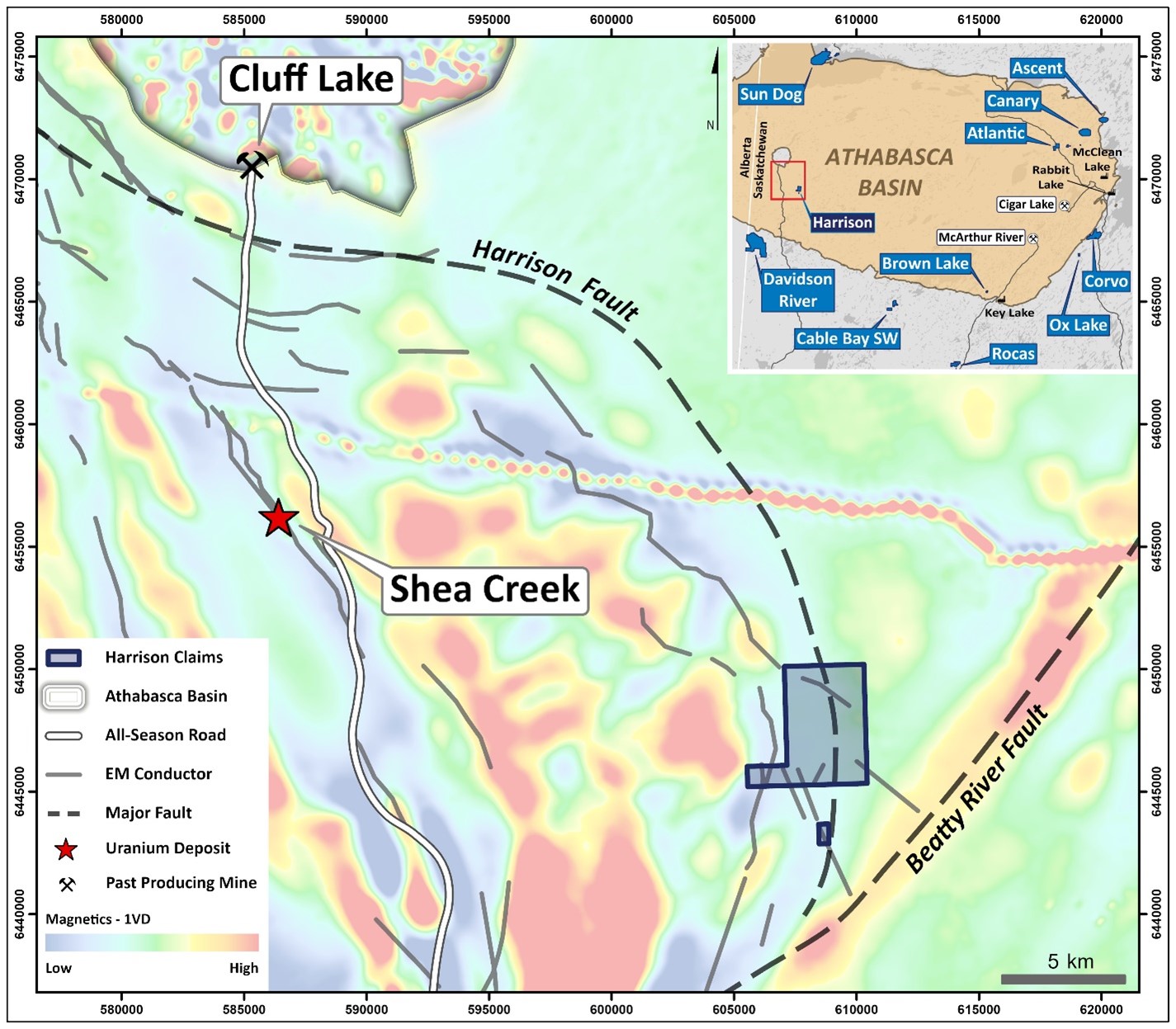

Figure 1. Overview map of Standard Uranium's eleven Athabasca properties, including the newly staked Harrison project. Harrison Project The Harrison project is comprised of two mineral claims totalling 1,750 ha, located 22 km SSE of the Shea Creek uranium deposits and approximately 30 km SE of the past producing Cluff Lake uranium mine (Figure 2). Electromagnetic ("EM") surveys conducted in 2006-2007 outlined multiple EM zones across the project. Harrison covers approximately 6.8 km of a NW-SE conductor trends coincident with a prominent magnetic low. The trend is crosscut by several interpreted fault zones, including 4.9 km of the major Harrison fault. The project has never been drill tested, and provides the Company with additional exploration exposure in the southwest Athabasca uranium district.

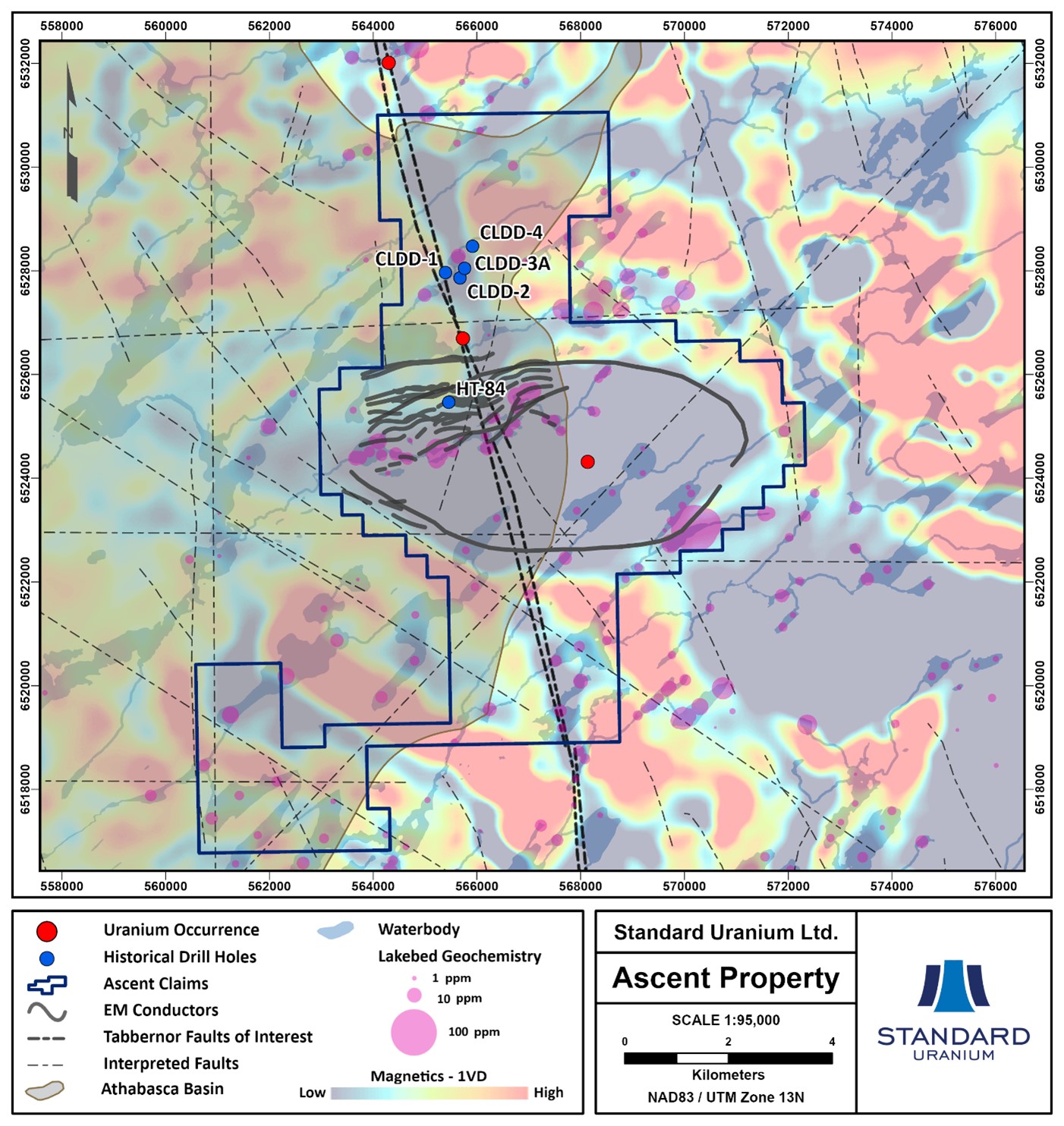

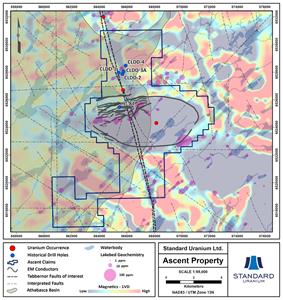

Figure 2. Plan map highlighting the Harrison fault zone and EM conductor trends on the Harrison project, with first vertical derivative magnetics in the background. The Company believes the newly acquired Harrison project is prospective for the discovery of high-grade unconformity-related uranium mineralization. Continued land acquisitions through staking efforts fits with the Company's strategy to increase its landholdings in the Athabasca Basin of Saskatchewan, Canada. Ascent Project Expansion Standard Uranium holds a 100%-interest in the Ascent project which straddles the eastern boundary of the Athabasca Basin (Figure 3). The recently expanded project consists of four mineral dispositions totalling 7,464 hectares. As the property lies on the edge of the Basin, depth to the sub-Athabasca unconformity is known to be approximately 50 metres from surface at maximum, while the eastern portion of the project contains no Athabasca sandstone cover, providing shallow drill target areas. In 2022, the Company completed a helicopter-borne Xcite time domain electromagnetic (TDEM), magnetic, and radiometric survey over the Ascent project. The airborne EM survey detected several conductive anomalies and radiometric variances on the Ascent Property, which correlate with previous electromagnetic surveys and lake sediment geochemical anomalies, effectively enhancing the resolution of the conductive trends on the Project. Additionally, the magnetic survey contributes to definition of potential fault systems and structural trends not previously identified. Regional prospecting by historical operators also identified uranium enrichment in basement rocks located east of the Athabasca Basin edge, which support the exploration model for shallow sandstone and basement hosted uranium on the property. The expansion of the project covers a suite of additional historical uranium anomalies, in addition to several more km of the Athabasca Basin edge and prospective regional structural trends. The current exploration model for the Ascent project is analogous to that of the J-Zone and Roughrider deposits, that are located proximal to a similar airborne EM target that has dimensions of roughly 2-km long by 1-km wide. The Ascent EM target is interpreted by the Company to represent a shallow-dipping conductive system and will be the focus of future exploration programs, drawing on the analogy of the J-Zone and Roughrider uranium deposits. Ascent Project Earn-In Option Agreement The Company has signed a term sheet (the "Term Sheet"), dated January 9, 2024, with Summit Fusion Pty. Ltd. (the "Optionee" or "Summit"), an arms-length private, Australian company. Pursuant to the Term Sheet, the Optionee will be granted the option (the "Option") to earn a 75% interest in the Ascent Project. The Option is exercisable by the Optionee in three stages, summarized in Table 1. Table 1. Summary of Option Agreement Terms

Figure 3. Plan map highlighting major structural zones and EM conductor trends on the expanded Ascent project, with first vertical derivative magnetics in the background. A Media Snippet accompanying this announcement is available by clicking on this link. Upcoming Events The Company will be presenting at the Red Cloud Financial Services Pre-PDAC 2024 Mining Showcase on February 29 and March 1, 2024 in Toronto, Ontario. The Company will also be attending the Prospectors & Developers Association of Canada Convention from March 3rd – 6th in Toronto, Ontario. Standard Uranium is attending the 2024 Energy Transition Metals Summit in Washington, DC from April 29-30. Shareholder Approval of 10% Rolling Omnibus Incentive Plan The Company is also pleased to announce the adoption of its new omnibus incentive plan (the "Omnibus Plan"), which was approved by the Company's shareholders at the annual and special meeting of shareholders held on November 10, 2022. The Omnibus Plan was created to comply with the requirements of the new TSX Venture Exchange Policy 4.4 – Security Based Compensation, effective November 24, 2021 and provides flexibility for the Company to grant equity-based incentive awards ("Awards") in the form of stock options ("Options"), deferred share units ("DSUs") and restricted share units ("RSUs"). The Omnibus Plan replaced the Company's existing stock option plan and includes a 10% "rolling" option plan permitting a maximum of 10% of the issued and outstanding common shares of the Company as at the date of any security-based grant to be reserved for grant. Please refer to the Company's management information circular dated October 24, 2022, which is available under the Company's profile on SEDAR+ for a copy and summary of the Omnibus Plan. QP Statement The scientific and technical information contained in this news release, including the sampling, analytical and test data underlying the technical information contained in this news release, has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President & VP Exploration of the Company and a "qualified person" as defined in NI 43-101. About Standard Uranium (TSX-V: STND) We find the fuel to power a clean energy future Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in the world's richest uranium district. The Company holds interest in over 209,867 acres (84,930 hectares) in the world-class Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development. Standard Uranium's Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected. Standard Uranium's eight eastern Athabasca projects comprise thirty mineral claims over 32,838 hectares. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries. Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area. For further information contact: Jon Bey, Chief Executive Officer, and Chairman Suite 918, 1030 West Georgia Street Vancouver, British Columbia, V6E 2Y3 Tel: 1 (306) 850-6699 Cautionary Statement Regarding Forward-Looking Statements This news release contains "forward-looking statements" or "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements include, but are not limited to, statements regarding: execution of the definitive agreement; conditions to the exercise the Option; completion of the Optionee's go public transaction; the timing and content of upcoming work programs; geological interpretations; timing of the Company's exploration programs; and estimates of market conditions. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by forward-looking statements contained herein. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Certain important factors that could cause actual results, performance or achievements to differ materially from those in the forward-looking statements are highlighted in the "Risks and Uncertainties" in the Company's management discussion and analysis for the fiscal year ended April 30, 2023. Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company's actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors or assumptions used to develop forward-looking statements include, without limitation: that the transaction with the Optionee will proceed as planned; the future price of uranium; anticipated costs and the Company's ability to raise additional capital if and when necessary; volatility in the market price of the Company's securities; future sales of the Company's securities; the Company's ability to carry on exploration and development activities; the success of exploration, development and operations activities; the timing and results of drilling programs; the discovery of mineral resources on the Company's mineral properties; the costs of operating and exploration expenditures; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); uncertainties related to title to mineral properties; assessments by taxation authorities; fluctuations in general macroeconomic conditions. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Any forward-looking statements and the assumptions made with respect thereto are made as of the date of this news release and, accordingly, are subject to change after such date. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release. Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dad340a4-e3c3-48a1-9251-b1fcd50256b3 https://www.globenewswire.com/NewsRoom/AttachmentNg/2b17575a-f0b7-4e0e-a53b-22a7ec7b873d https://www.globenewswire.com/NewsRoom/AttachmentNg/915c456d-d4b1-43c6-a68b-790bb80b59de  Figure 1.Overview map of Standard Uranium's eleven Athabasca properties, including the newly staked Harrison project.Figure 2.Plan map highlighting the Harrison fault zone and EM conductor trends on the Harrison project, with first vertical derivative magnetics in the background.Figure 3.Plan map highlighting major structural zones and EM conductor trends on the expanded Ascent project, with first vertical derivative magnetics in the background.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||