Bookmark This Page

| Wednesday's ETF with Unusual Volume: ARGT

Wed, 08 May 19:20:12 GMT |

| Daily Dividend Report: EXPD,DHR,CAH,PRU,SU

Wed, 08 May 16:02:17 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

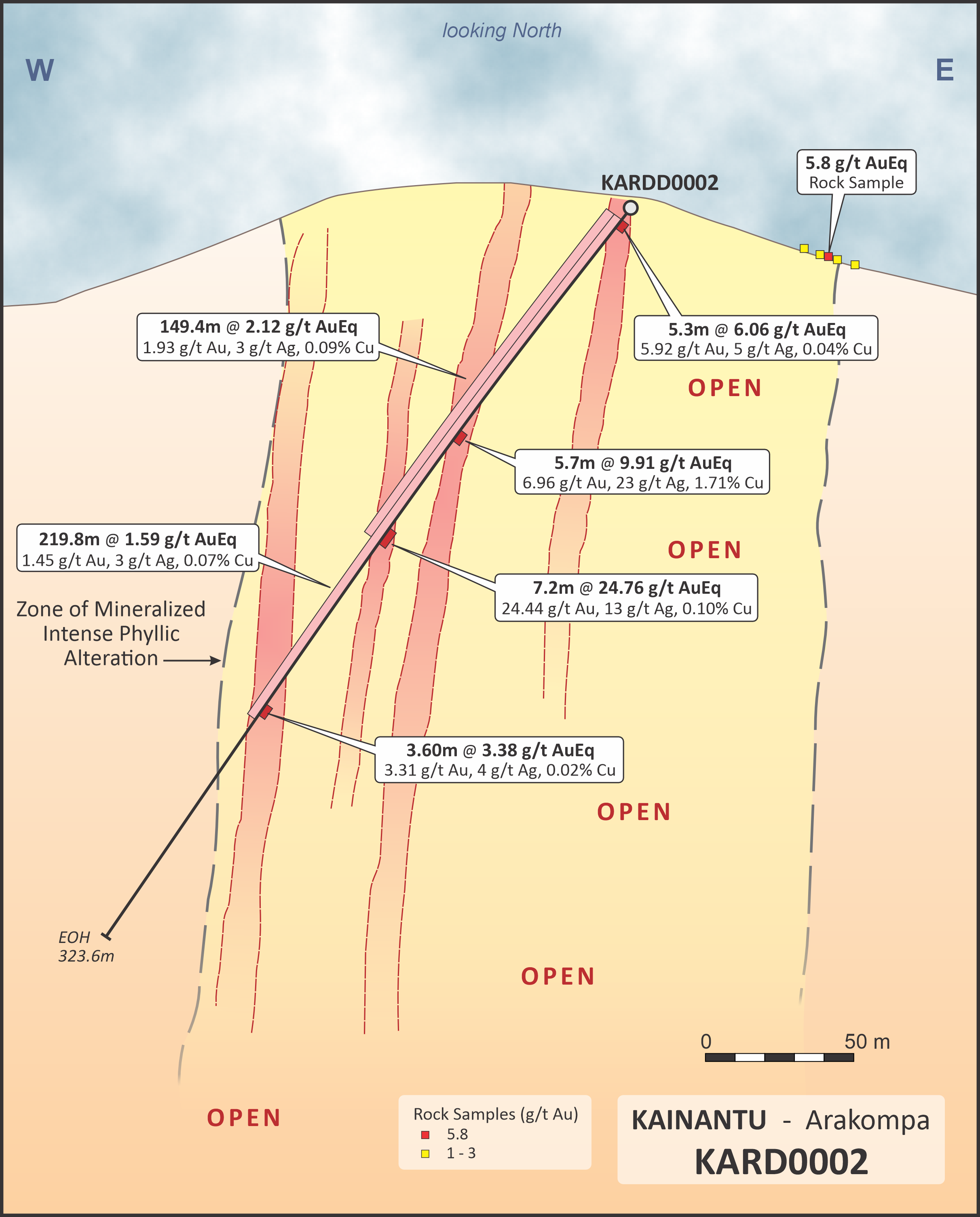

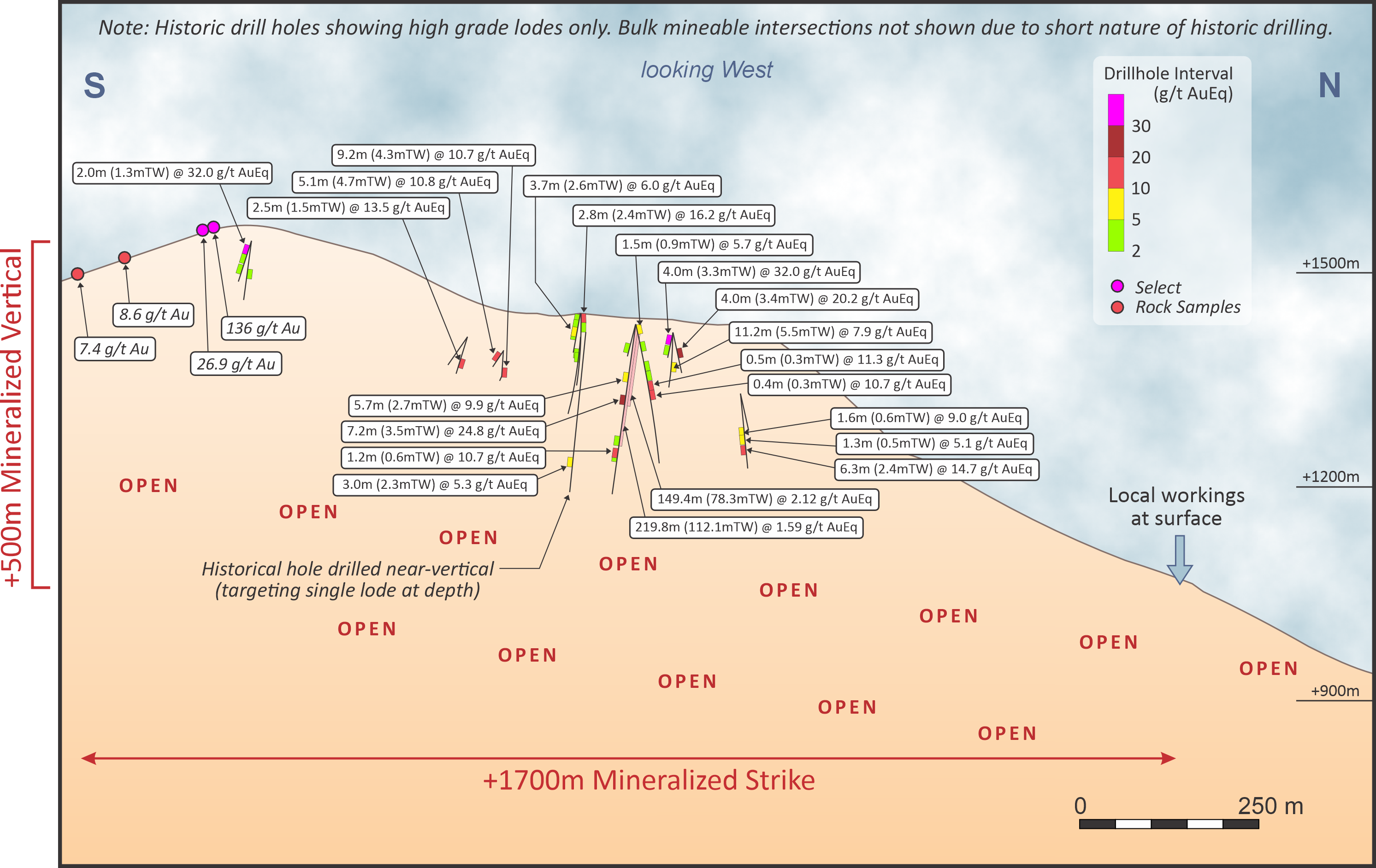

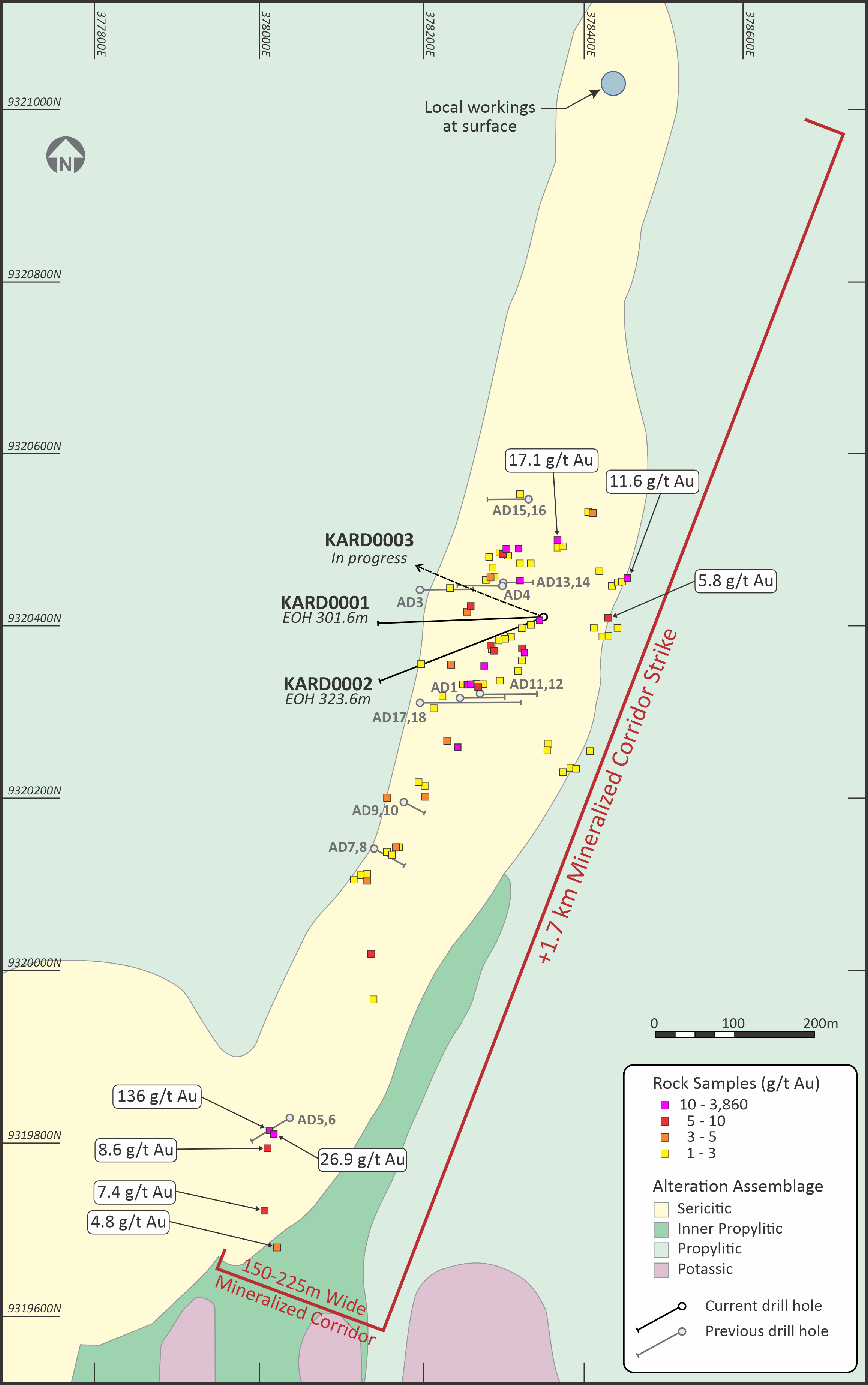

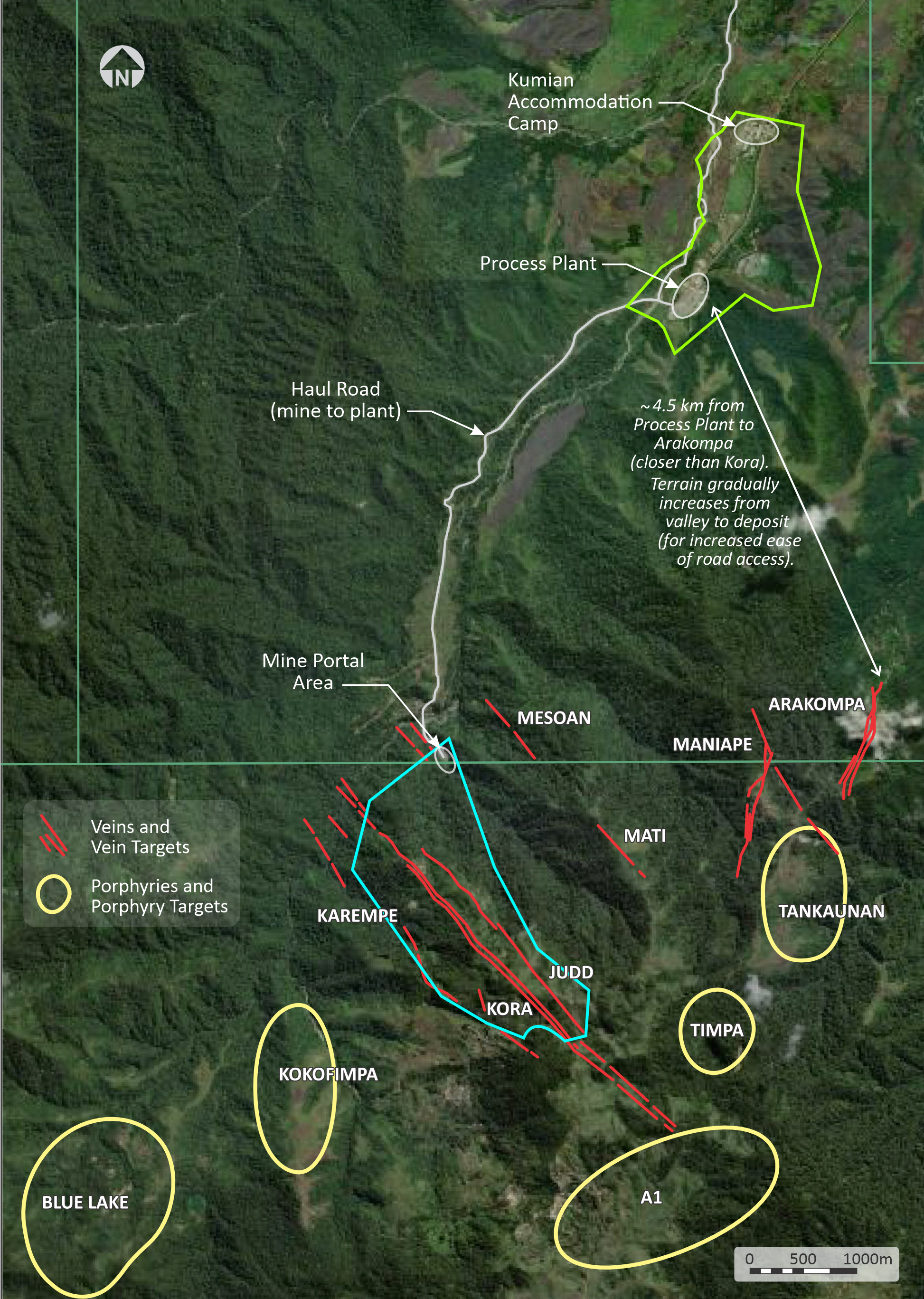

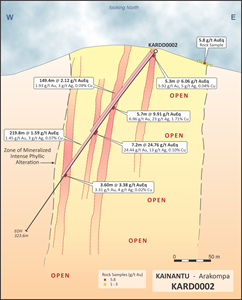

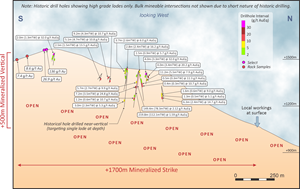

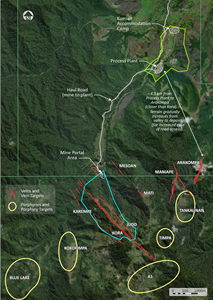

Notes: John Lewins, K92 Chief Executive Officer and Director, stated, "We are very excited to be announcing the first two drill hole results from Arakompa, demonstrating very high potential from both the multiple intersections and significant size potential from surface sampling, drill holes and local workings covering a strike of 1.7 km, a mineralized corridor of approximately 150 to 225 metres wide, and a demonstrated vertical extent of over 500 metres. Arakompa is also near infrastructure, located closer to the process plant than Kora and Judd, with relatively gradual terrain for road access up from the Markham Valley, and importantly, represents a highly prospective opportunity to potentially grow production at Kainantu beyond the Stage 4 Expansion (see Figure 4). Plans have already been actioned to expand the program at Arakompa in the near-term." Chris Muller, K92 Executive Vice President Exploration, stated, "The Arakompa project represents another vein system analogous to the Kora-Judd consolidated corridor, with just as much potential. In addition to the high grade massive sulphide veins, the intervening gold mineralization at Arakompa is well developed and intimately associated with widespread phyllic alteration likely representing the upper expressions of a fertile porphyry at depth. Almost all of the 18 holes drilled by former operators, Renison Goldfields Consolidated Limited and Highlands Gold Limited, intersected excellent gold-rich intercepts, even with only 1,766 metres drilled historically. Though drill tested over a substantial strike length, drilling by these companies only tested the very shallow parts of the veins. Clear indications of the vein system at surface, around 1000m RL, are a testament to even greater strike potential to the north and exceptional depth extent as well. The proximity of the Arakompa mineralized corridor to the Kainantu Gold Mine infrastructure, even closer to the Lae-Madang Highway than Kora, is a significant attribute and will enable a major drilling campaign to be carried out cost effectively. We look forward to working with our stakeholders to delineate potentially the next major resource for Papua New Guinea." VANCOUVER, British Columbia, Feb. 21, 2024 (GLOBE NEWSWIRE) -- K92 Mining Inc. ("K92" or the "Company") (TSX: KNT; OTCQX: KNTNF) is pleased to announce the results of the first two drill holes completed from its maiden drill program at Arakompa at the Kainantu Gold Mine in Papua New Guinea. Arakompa is near infrastructure, located approximately 4.5 km south-east of the Kainantu Gold Mine's processing plant, and closer to the process plant than the producing Kora and Judd vein systems, located approximately 3 km south-west of Arakompa. K92's recently completed hole KARDD0002 is the longest hole drilled in the history of the project, intersecting significant mineralization including 4 lodes recording 7.20 m at 24.76 g/t AuEq (3.46 m true thickness), 5.70 m at 9.94 g/t AuEq (2.74 m true thickness), 5.30 m at 6.06 g/t AuEq (2.92 m true thickness) and 3.60 m at 3.37 g/t AuEq (1.73 m true thickness). One of the lodes, intersecting 5.70 m at 9.94 g/t AuEq, recorded significant chalcopyrite and bornite mineralization, with the copper component grading 1.7%. High grade lode mineralization appears to have significant similarities to Kora and Judd (see Arakompa Vein System Background below). Additionally, results from hole KARDD0002 demonstrate potential for bulk mining at Arakompa. Between the lodes, the tonalite to dioritic host rock is mineralized, overprinted with porphyry style gold-copper mineralization. Hole KARDD0002 recorded a bulk intersection of 219.8 m at 1.59 g/t AuEq (112.1 m true thickness) with a higher grade core of 149.4m at 2.12 g/t AuEq (78.4 m true thickness), starting at 5.2 m from surface (see Figure 1). Importantly, hole KARDD0002 drilled approximately only two-thirds of the width of the mineralized corridor, with the eastern one-third untested and prospective as shown via rock samples, including 5.8 g/t Au and 11.6 g/t Au. The maiden drilling results are the first holes completed in 32 years, with limited and shallow drilling completed historically (18 holes, 1,766 m drilled). Of the 18 holes drilled historically, there were 15 intersections above 5 g/t AuEq, 8 intersections above 10 g/t AuEq and 3 intersections above 20 g/t AuEq, with highlights including:

Surface field work completed historically and by K92 has demonstrated that the target size of Arakompa is significant, with mineralization observed from drill holes, rock samples and surface workings for at least 1.7 km of strike, hosted within an approximately 150 to 225 m wide mineralized intense phyllic altered package, and a vertical extent of over 500 metres. Plans are already in place to expand exploration activities in the near term. Arakompa Vein System Background The Arakompa project is interpreted to be an intrusive related gold-copper-silver epithermal vein system with similarities to the producing Kora and Judd vein systems. A significant difference at Arakompa is that it is hosted in tonalite to dioritic rock, whereas Kora and Judd are hosted predominantly in metasediments (phyllite). Mineralization at Arakompa is in pronounced vein lodes but is also widespread across a very broad envelope, hosted in strongly altered tonalite and diorite. This has been interpreted to have resulted from collapsing argillic and advanced argillic alteration and the propylitic alteration of the basement tonalite are interpreted to originate from the intrusion of a large magmatic porphyry body. Phyllic alternation appears to be associated with gold mineralization, providing a large halo (at least 100 m wide) around the vein corridor. There has likely been an upwelling of phyllic alteration from the porphyry into the high grade veins. This has resulted in mineralization between the veins, providing the potential for bulk mining. Multi-stage mineralizing events with several phases of quartz-sulphide development is apparent within the veins themselves. The sequence of early quartz deposited from a mesothermal dilute fluid followed by pyrite-copper-gold ± Bi-Te-Pb-Zn-Sn mineralization at Arakompa has many similarities to the same events encountered at Kora and Judd. The main sulphides are pyrite, chalcopyrite, bornite and bismuthinite. As at Kora, chalcopyrite forms late, overprinting early phases of pyrite. Gold is documented in petrological reports and shown in photomicrographs as occurring in quartz, or often as inclusions overgrown by chalcopyrite. Porphyry evidence is widespread at Arakompa. Localised, high level B veins (quartz with centreline pyrite) are present, typical of the upper parts of a porphyry system. Magnetite-epidote alteration represents classic prograde porphyry assemblages, indicative of the inner propylitic shell. Chalcocite is also locally present, suggesting an underlying copper-enriched body. Figures A cross section showing KARDD0002 at Arakompa is provided in Figure 1. A long section showing Arakompa drilling to date is provided in Figure 2. A plan map for Arakompa is provided in Figure 3. A location map is provided in Figure 4. Core photographs are provided of drill hole KARDD0002 in Figure 5. Mineralized specimen photographs of drill hole KARDD0002 in Figure 6. Table 1

Table 2

Table 3

Table 4

Drill Hole Sampling Methodology, QA/QC and Qualified Person The diamond drill hole is first logged to determine the sampling intervals, which range from a minimum of 0.1 metres to generally 1 metre. The drill core is sawn half core cut along a reference line, with the remainder of the core returned to the core tray. Core samples are then placed in numbered calico and plastic bags, with a numbered sample ticket for dispatch to the assay laboratory. Samples are separately assayed for gold, copper and silver. K92's procedure includes the insertion standards, blanks and duplicates. Gold assays are by the fire assay method. Copper and silver assays are by three-acid-digestion method (nitric, perchloric & hydrochloric mix). K92 maintains an industry-standard analytical quality assurance and quality control (QA/QC) and data verification program to monitor laboratory performance and ensure high quality assays. Results from this program confirm reliability of the assay results. All sampling and analytical work for the mine exploration program is performed by Intertek Testing Services (PNG) Ltd, an independent accredited laboratory that is located on site. External check assays for QA/QC purposes are performed at SGS Australia Pty Ltd in Townsville, Queensland, Australia. K92 Executive Vice President Exploration, Mr. Chris Muller, PGeo, and K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, MAIG, both Qualified Persons under the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"), have reviewed and are responsible for the technical content of this news release. In addition to the analytical QA/QC program outlined above, data verification also includes significant time onsite reviewing drill core, soil and outcrop sampling, artisanal workings, as well as discussing work programs and results with geology personnel and external consultants. About K92 K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018 and is in a strong financial position. A maiden resource estimate on the Blue Lake porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience. On Behalf of the Company, John Lewins, Chief Executive Officer and Director For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, and the Kainantu 2022 Preliminary Economic Assessment, including the Stage 3 Expansion, a new standalone 1.2 mtpa process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 virus; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company's operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development of the Kora, Judd, Arakompa and other projects; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company's ability to carry on current and future operations, including development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company's foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company's Annual Information Form under the heading "Risk Factors". Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Figure 1 – Arakompa Cross-Section – Showing KARDD0002

Figure 2 – Arakompa Long Section

Figure 3 – Arakompa Plan Map

Figure 4 – Site Map and Location of Arakompa, located near infrastructure (~4.5km from the Process Plant).

Figure 5 – KARDD0002 Core Photograph, 144.28 – 149.80m; within intersection of 7.2m at 24.44 g/t Au, 0.10 % Cu, 13 g/t Ag.

Figure 6 – KARDD0002 Mineralized Specimens Photographs.

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6c9bcdc2-ca80-4d1a-bd53-3684d19885c3 https://www.globenewswire.com/NewsRoom/AttachmentNg/655ff696-2714-4377-a6f5-7b219ade91b4 https://www.globenewswire.com/NewsRoom/AttachmentNg/e1013c4f-55bc-464b-8e06-f395a5d7a58b https://www.globenewswire.com/NewsRoom/AttachmentNg/777e0617-68e5-4707-84d8-26f0794dc13b https://www.globenewswire.com/NewsRoom/AttachmentNg/4da86829-42b3-4b20-85ae-444c5c7a7ef9 https://www.globenewswire.com/NewsRoom/AttachmentNg/348303ba-13f3-4408-89ea-96daf4f902b8

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||