Bookmark This Page

| Friday's ETF with Unusual Volume: RSPU

Fri, 03 May 16:24:07 GMT |

| S&P 500 Analyst Moves: CTRA

Fri, 03 May 16:12:25 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

Murchison Minerals Commences Drilling at BMK Project Targeting Copper-Rich Stockwork Zone

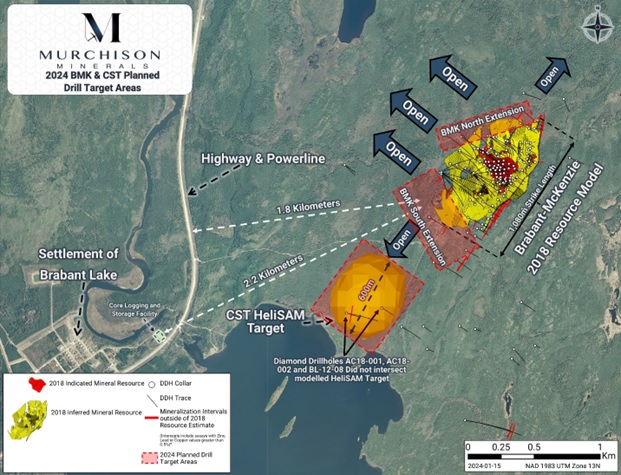

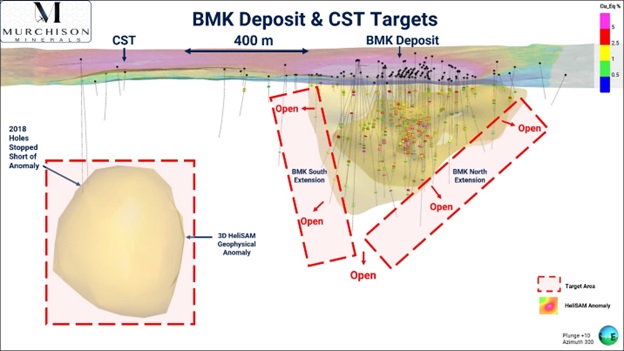

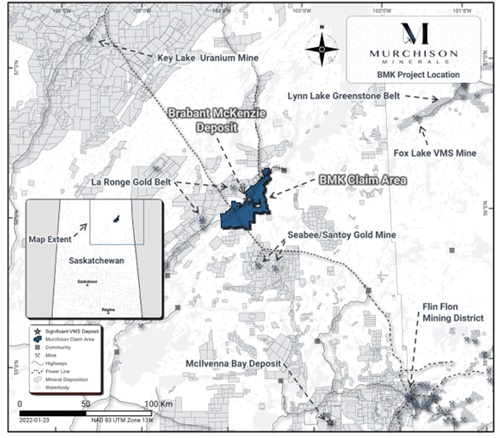

BURLINGTON, ON / ACCESSWIRE / January 22, 2024 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR)(OTCQB:MURMF) is pleased to announce the commencement of the 2024 Winter Exploration Program (the "Program") at its 100%-owned Cu-Zn-Ag-Pb-Au Volcanogenic Massive Sulphide (VMS) BMK Project in Saskatchewan. The Program is comprised of diamond drilling totaling approximately 3,500 m and is expected to be completed by mid-March. Cyr Drilling of Sunnyside, Manitoba was selected as the drill contractor. The objective of the Program is the discovery of the copper-rich stockwork zone predicted - due to the high-grade nature - to be associated with the formation of the of the BMK VMS Deposit. The Program will focus on testing three target areas: CST, BMK North and BMK South Extensions.  Figure 1: Plan Map View of BMK Deposit and CST zone with drill target areas highlighted in red.  Figure 2- Long Section View of BMK Deposit and CST Geophysical Anomaly, highlighting target areas for 2024 drill program. 2024 Winter Exploration Program: The Program will focus on diamond drill exploration, utilizing one drill. Murchison maintains a year-round core processing facility, and accommodations within the nearby - 2.5 km - community of Brabant Lake, SK. The BMK Project site is easily accessible with maintained road access within 1.8 km of the Deposit, while exploration target areas have well established drill-trails. The Company has secured all necessary permits and approvals for the Program. The BMK Deposit has a 2018 NI 43-101 resource estimate of 2.1 Mt indicated at 0.69% Cu, 7.08% Zn, 0.49% Pb, 39.6 g/t Ag, 0.23 g/t Au and 7.6 Mt of inferred at 0.57% Cu, 4.46% Zn, 0.19% Pb, 18.42 g/t Ag, and 0.1 g/t Au (See NI 43-101 dated September 4, 2018) and remains open along strike and at depth. Recent work completed by subject matter expert Dr. Stephen J. Piercy, Professor at Memorial University NFLD, has aided in an updated geological interpretation of the BMK Deposit. The updated geological interpretation indicates that the BMK Deposit should have an associated copper stockwork zone (see release dated June 7, 2023) which is typical in most VMS deposits, and has yet to be discovered at BMK. The copper stockwork zone represents a target which could considerably add to the BMK resource, and its identification is of top priority for Murchison. During the Program, the Company will drill test three high priority areas. i). The CST target (Figure 1 & 2), a large geophysical anomaly, reidentified in a 2017 Heli-SAM survey (hybrid ground/airborne electromagnetic survey). The target is considered prospective due to its similar conductance to that of the BMK Deposit, as well as being only 400 metres south of the BMK Deposit directly along strike. The large size and proximity of the anomaly to the BMK Deposit may indicate a copper stockwork zone or an additional lens of massive sulphide mineralization. ii). BMK South Extension target, located south of the current extents of the defined BMK Deposit. The target area is along strike from multiple high-grade copper intercepts at the southern edge of BMK. iii). BMK North Extension target, located north of the current extents of the defined BMK Deposit. The target area is along strike from multiple high-grade copper intercepts at the northern edge of BMK Deposit. 2023 Fall Exploration Program at BMK: Murchison has recently received geophysical data from the fall 2023 ground electro-magnetic (EM) survey over the CST target (see release dated November 8, 2023). The EM survey consisted of two lines, 1 line was 2 km long and the other 1 km long with 50-metre spaced reading stations oriented perpendicular over the CST anomaly. The survey was used as confirmation of the 2017 geophysical data, and they survey successfully confirmed a strong EM response coincident with the previously modelled anomaly. This geophysical survey provided confidence in the robustness of the previous geophysical anomaly and confirmed it as high priority drill target for Murchison. One (1) hole drilled in 2021 was also selected for a borehole EM survey. This hole detected a significant off-hole anomaly but unfortunately the hole was plugged at the 400-metre level which is approximately where the anomaly was located, and where mineralization had been encountered in the hole. The blocked hole was a hindrance to be able to provide full resolution to the borehole EM results however there is still sufficient data to highlight a significant response directly west of the hole. This off-hole anomaly is located at the far southern extent of the BMK Deposit and is planned to be drill tested during the winter program. Murchison Minerals' Vice-President of Exploration John Shmyr comments: "The 2024 Exploration Program at the BMK Project is the culmination of many months of planning and preparation. The team has spent months updating our geologic interpretation of the BMK Deposit and it has reinforced our views on the high potential of the project. The work that Dr. Piercy has done gives us a tremendous amount of confidence in our thesis that a copper stockwork zone should be associated with the BMK Deposit. Additionally, the team is particularly excited about the CST target since it is only 400 meters away from the Deposit, directly on strike. The 2024 Program is the first step in unlocking the potential of the BMK Project, and we are thrilled to be back here exploring." OTC Venture Market The Company wishes to announce that its last day of trading on the OTC Venture Market ("OTCQB") will be on January 31, 2024. For February 2024 onwards, US investors will still be able to trade the common shares of the Company via OTC's "Pink Sheet". Qualifying Statement The foregoing scientific and technical disclosures on the BMK Project have been reviewed by John Shmyr, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Mr. Shmyr is a Qualified Person as defined by National Instrument 43-101. The Qualified Person has verified the data disclosed in this release, including sampling, analytical and test data underlying the information contained in this release. Mr. Shmyr consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears. Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's properties. About the BMK Project The Brabant-McKenzie Project is located 175 kilometres northeast of La Ronge, Saskatchewan and approximately three kilometres from the community of Brabant Lake. The area is accessed year-round via provincial Highway 102 and is serviced by grid power. The project hosts the Brabant-McKenzie VMS Deposit, and the mineral claims total 664 square kilometres, that cover approximately 37 kilometres of strike length of the favourable BMK trend.The project contains multiple known mineralized showings such as the Main Lake and Betty Showings and with many identified geophysical conductors that have yet to be drill tested.  Figure 3: Location map of BMK Project. Mineral Resource Summary for BMK VMS Deposit

The above mineral resource estimate for the Brabant-McKenzie VMS Deposit was prepared by an independent qualified person ("QP") Finley Bakker, P. Geo., and has an effective date of September 4, 2018. The NI 43-101 Technical Report named Technical Report on the Resource Estimate Update for the Brabant-McKenzie Property, Brabant Lake, Saskatchewan is available on the Company's website and on SEDAR. The Mineral Resource of the Brabant-McKenzie VMS Deposit was estimated based on metal prices of USD $1.20/lb Zn, $2.50/lb Cu, $1.00/lb Pb, $16.00/Oz. Ag, and $1,200/Oz. Au, and a USD exchange rate of $1.25. A Net Smelter Return (NSR) cut-off of $90/tonne and a 3.5% zinc equivalent based on above metal prices and an average recovery of 75% for all metals. About Murchison Minerals Ltd. (TSXV: MUR, OTCQB: MURMF) Murchison is a Canadian based exploration Company focused on nickel-copper-cobalt exploration at the 100% - owned HPM Project in Quebec and the exploration and development of the 100% - owned Brabant Lake zinc copper silver project in north central Saskatchewan. Murchison currently has 260.8 million shares issued and outstanding. Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.ca. For further information, please contact: Troy Boisjoli, President and CEO, Forward Looking Information The content and grades of any mineral deposits at the Company's properties are conceptual in nature. There has been insufficient exploration to define a mineral resource on the property and it is uncertain if further exploration will result in any target being delineated as a mineral resource. Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties. This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. FLI herein includes, but is not limited to: future drill results; stakeholder engagement and relationships; parameters and methods used with respect to the assay results; the prospects, if any, of the deposits; future prospects at the deposits; and the significance of exploration activities and results. FLI is designed to help you understand management's current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI. Assumptions upon which FLI is based, without limitation, include: the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the deposits; the accuracy of key assumptions, parameters or methods used to obtain the assay results; the ability of the Company to obtain required approvals; the results of exploration activities; the evolution of the global economic climate; metal prices; environmental expectations; community and nongovernmental actions; and any impacts of COVID-19 on the deposits, the Company's financial position, the Company's ability to secure required funding, or operations. Risks and uncertainties about the Company's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. SOURCE: Murchison Minerals Ltd. View the original press release on accesswire.com

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||