Bookmark This Page

| Daily Dividend Report: CBT,SPG,MCHP,D,LLY

Tue, 07 May 16:36:28 GMT |

| Friday's ETF with Unusual Volume: RSPU

Fri, 03 May 16:24:07 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

Green Star Royalties Announces Improved Regenerative Agriculture Carbon Royalty Structure and Verra Registration ProgressKey Highlights

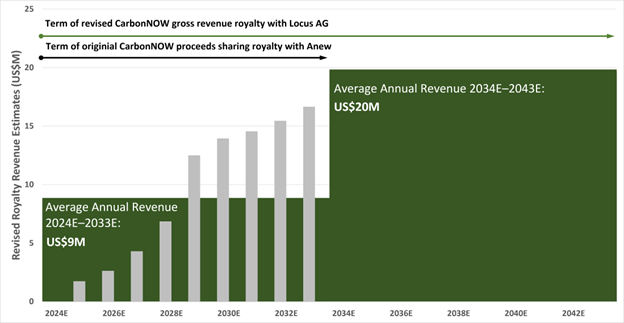

Alex Pernin, Chief Executive Officer of Star Royalties, commented: "We are excited to announce these multiple positive developments with the CarbonNOW program. The revised CarbonNOW structure creates an improved and strategic alignment with Locus AG and will drive superior workflow to maximize farmer enrollment and soil carbon sequestration, while Anew continues to provide key support services. The revised gross revenue royalty structure will also improve transparency and reduce risk, while the term extension from 10 to 20 years provides significantly greater exposure to longer-term carbon pricing and sequestration performance for the same royalty investment amount." "The program's listing with Verra marks an important milestone towards generating and issuing premium North American carbon credits from regenerative agricultural practices. We are seeing robust demand for nature-based solutions and anticipate these types of offsets to transact around US$20/tCO2e. Furthermore, our program has paid out approximately US$4.5 million to U.S. farmers and we look forward to continued farmer enrollment into the program." Vic Peroni, Chief Commercial Officer at Locus AG, commented: "We believe this strategic realignment with Green Star and Anew will provide significant operational and economic efficiencies for the CarbonNOW program and allow for Locus AG to improve the overall management and execution of the program with farmers. Green Star's commitment to the CarbonNOW program, the farmers and to Locus AG has always been apparent, and having a direct relationship with Green Star is crucial for the success of the overall program." Angela Schwarz, Chief Executive Officer of Anew Climate, LLC, reiterated the importance of the strategic realignment in ensuring the long-term success of the CarbonNOW program and further commented: "CarbonNOW incentivizes adoption of an innovative and additional solution to achieve land-based carbon removals. Anew has firm demand at significant volume for the CarbonNOW credits at substantially higher pricing than industry reports for nature-based credits. We are pleased to provide project development and marketing services in support of the CarbonNOW program and are confident that the voluntary carbon market will continue to demand and pay a premium for such projects due to their enormous contribution to climate action, biodiversity and natural capital." Improved CarbonNOW Structure, Economics and Royalty Term Extension CarbonNOW has been optimized to ensure maximum carbon removals and avoidance, as well as alignment between all involved parties. Green Star, Locus AG, Anew and certain of their affiliates have agreed to make Locus AG the project operator and formal manager of CarbonNOW. Locus AG will oversee all data management and continue to actively recruit farmers under this program until a total of 1.32 million acres of farmland across the United Sates have been enrolled. Anew will remain the program's carbon developer, leading registration and issuance efforts with Verra, as well as executing all carbon credit marketing and sales. Green Star will continue to finance CarbonNOW's initial eligible expenses, farmer payments and registration fees, through quarterly drawdowns by Locus AG, as required, until the previously committed capital contribution of up to US$20.6 million is fully invested. Green Star currently expects to provide the remaining US$15.1 million of capital contributions by 2026. As part of optimizing the program, Green Star will revise its proceeds sharing agreement that is currently with an affiliate of Anew. Green Star will partner directly with Locus AG and will receive a 30% gross revenue royalty, payable from CarbonNOW's gross carbon revenues. The royalty will be payable in cash from the sale of carbon credits or directly in carbon credits, at Green Star's election. The term of the royalty will also be increased from 10 years to 20 years of carbon credit issuance to better capture the longevity and durability of the CarbonNOW program. It should contribute significant incremental cash flow generation to Green Star through the early 2040's (see Figure 1). The revised royalty agreement will also account for and incorporate the impact of recent revisions in VM0042 (as described below), ensuring the competitiveness and robustness of the CarbonNOW program across the extended royalty term. Approximately 310,000 acres of U.S. farmland are currently enrolled in the program, representing the full scope of the original pilot program. As part of this triparty optimization effort, significant focus has been placed on increasing the selectivity of eligible growers to prioritize the highest quality acres and to maximize the carbon sequestration potential of these acres. This approach will ensure a consistently measured and effective ramp-up pace towards the 1.32 million acres. Green Star's attributable cash flow from the CarbonNOW program is estimated to represent approximately 75,000 carbon credits in 2025, increasing towards 400,000 carbon credits per year over the following 20 years.  Figure 1: Green Star's Revised Estimated Royalty Revenues from CarbonNOW Verra Registration Progress The CarbonNOW program was officially listed under VM0042 on September 19, 2023, under the "Anew Agri-carbon Aggregation 1" project (ID 4236). The project's 30-day public consultation period was completed in October. CarbonNOW is now transitioning to its validation phase with the engagement of a third-party validation and verification body. Anew expects the validation process to commence by Spring 2024 and be completed by Fall 2024. Given that VM0042 was only publicly released in late May 2023 and given its additional conservatism as well as other Verra VCS Standard revisions, CarbonNOW will look to combine the 2022 and 2023 growing seasons to more effectively and efficiently quantify the cumulative carbon sequestration potential under one verification process. The verification phase is expected to commence following validation in Fall 2024 and would result in CarbonNOW's first offset issuance, as well as first royalty revenues to Green Star, in 2025. Farmer Payments The approximately US$4.5 million paid to U.S. farmers to-date has funded ongoing enrollments in the CarbonNOW program and signifies its rapid year-over-year growth. By financially incentivizing practice changes, Green Star and Locus AG, with support from Anew, are assisting farmers in fulfilling their crucial role in decarbonizing the food system. The CarbonNOW program involves the application of probiotic-based soil additives, known as biologicals, that increase soil fertility and plant productivity, and in turn, soil carbon sequestration. As part of the program, farmers will receive incentive payments for the soil additives and per-acre payments upfront to overcome financial barriers to implementation. Additional carbon-linked payments will be paid to farmers based on the net carbon sequestration performance of their acreage, following data collection and verification of soil samples that result in per-acre carbon crediting. In 2023 alone, over 22,000 soil carbon samples were taken across CarbonNOW's enrolled acres. The rigorous verification process is intended to provide transparency and assurance for quality-conscious buyers, who are drawn to regenerative agriculture for its climate mitigation impacts, as well as its benefits to U.S. farming communities. Engagement of Market Maker Star Royalties has retained Integral Wealth Securities Ltd. ("Integral") to provide market-making services in accordance with TSX Venture Exchange policies. Integral will trade shares of the Company on the TSX Venture Exchange to maintain an orderly market and improve the liquidity of Star Royalties' shares. Under the agreement between the Company and Integral ("Agreement"), Star Royalties has agreed to pay Integral a monthly fee of C$6,000 plus applicable taxes. The initial term of the Agreement is three months, and such term will be automatically renewed month-to-month, unless terminated by the Company on 30 days' prior written notice. Integral will not receive any shares or options as compensation. Star Royalties and Integral are unrelated and unaffiliated entities. Integral has informed the Company that it has no present, direct or indirect, interest in Star Royalties or any securities of Star Royalties. Integral is an independently owned investment dealer with head offices in Toronto, Ontario and is a member of Canadian Investment Regulatory Organization and a member firm of the TSX Venture Exchange. CONTACT INFORMATION For more information, please visit our website at starroyalties.com or contact:

About Locus Agriculture Locus Agriculture (Locus AG) is an agriculture biological company that consistently pairs the most vital inputs with data-driven guidance to help growers achieve more productive, sustainable crops. Its globally recognized CarbonNOW carbon farming program gives farmers a new way to boost yields, profit and accelerate carbon sequestration while reducing operating costs and environmental impact. Locus AG gets its core scientific capabilities from its parent company, Locus Fermentation Solutions (Locus FS), an Ohio-based green technology powerhouse. For more information, visit LocusAG.com. About Anew Carbon Farming, LLC and Anew Climate, LLC Anew Carbon Farming, LLC ("ACF"), a wholly owned subsidiary of Anew Climate, LLC ("Anew"), facilitates Anew's engagement in regenerative agriculture projects. Anew is accelerating the fight against climate change by enabling companies and organizations to align their goals for conservation and impact with actionable next steps. With a comprehensive solutions portfolio that includes advisory services, carbon credits, renewable natural gas, renewable energy certificates, EV credits, and emission credits, Anew lowers barriers to participation in environmental markets for clients across the private and public sectors. As a leading marketer and originator of environmental products, the company brings together strategic finance, regulatory expertise, scientific knowledge, and impact focus to make it possible for businesses to thrive while building a sustainable future. Anew is majority owned by TPG Rise, TPG's global impact investing platform, and emerged from the February 2022 combination of durational industry leaders Element Markets, LLC and Blue Source, LLC. The company has offices in the U.S., Canada, and Europe, and an environmental commodities portfolio that extends across five continents. About Star Royalties Ltd. Star Royalties Ltd. is a precious metals and carbon credit royalty and streaming company. The Company innovated the world's first carbon credit royalties in forestry and regenerative agriculture through its pure-green joint venture, Green Star Royalties Ltd., and offers investors exposure to precious metals and carbon credit prices with an increasingly negative carbon footprint. The Company's objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders. CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION Certain statements in this news release may constitute "forward-looking statements", including those regarding future market conditions for metals, minerals and carbon offset credits, future capital raising opportunities, future funding under the proceeds sharing agreement and the future business growth of Green Star. Forward-looking statements are statements that address or discuss activities, events or developments that the Company or Green Star expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties and Green Star to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, carbon pricing and carbon tax legislation and regulations, risks inherent to the development of the ESG-related investments and the creation, marketability and sale of carbon offset credits by the parties, the potential value of mandatory and voluntary carbon markets and carbon offset credits, including carbon offsets, risks inherent to royalty companies, execution of the proceeds sharing agreement on the terms contemplated herein, title and permitting matters, operation and development risks relating to the parties which develop, market and sell the carbon offset credits from which Green Star will receive royalty payments, changes in crop yields and resulting financial margins regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, dilution, risk inherent to any capital financing transactions, risks inherent to a possible Green Star go-public transaction, the nature of the governance rights between Star Royalties, Cenovus Environmental Opportunities Fund Ltd. and Agnico Eagle in the operation and management of Green Star and competition. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law. SOURCE: Star Royalties Ltd. View the original press release on accesswire.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||