Bookmark This Page

| Daily Dividend Report: PH, SYY, XOM, CVX, BAC

Fri, 26 Apr 16:24:29 GMT |

| Daily Dividend Report: PFE, SCHW, CI, MPC, AVY

Thu, 25 Apr 17:45:00 GMT |

|

|

Get a quote box (like the one below) for your site!

|

energy quotes gold quotes

uranium stocks

solar power stocks

wind power stocks

Industry focus:

advertising stocks,

space stocks,

aerospace stock,

aerospace sector,

list of aerospace companies,

largest chemical companies,

chemical stock,

chemical news,

best agriculture stocks,

ag stocks,

chinese agriculture stocks,

top agriculture companies,

agriculture stocks,

agricultural stocks,

agricultural stock,

stocks agriculture,

agriculture markets,

agriculture index,

agriculture industries,

agricultural investment,

agriculture investment,

agricultural industry,

farm stock,

airline stock symbols,

airline stock prices,

airline stock,

airlines stock,

clothing stock,

fashion stocks,

publicly traded fashion companies,

clothing company stocks,

apparel stock,

apparel companies,

application software stocks,

asset management stocks,

auto stocks,

auto industry stocks,

chinese auto stocks,

auto stock prices,

automotive stock,

auto parts stocks,

community bank stocks,

regional bank stocks,

canadian bank stocks,

banking stock,

national bank stocks,

commercial bank stock,

banks stock,

bank stock quote,

bank stocks,

banking industry,

alcohol stocks,

beverage stock,

global wine stocks,

wine stocks,

liquor stock,

biotech stocks list,

biotechnology investing,

public biotech companies,

top biotech stocks,

nanotechnology stock,

largest biotech companies,

biotechnology stock,

biotech investing,

investing in biotech,

best biotech companies,

bio stocks,

biotech sector,

biotechnology investment,

biopharma companies,

new biotech companies,

biotech investment,

biotechnology industries,

nanotech stocks,

biotech stocks,

biotechnology articles,

biotechnology news,

business stocks,

service stocks,

chemical companies,

chemical industries,

chemical industry,

chemical company,

chemicals company,

cigarette stock,

cigarette company stocks,

cigarette stock symbols,

tobacco company stocks,

tobacco stock,

cigar stocks,

communications stocks,

communication stock,

computer peripherals companies,

computer peripherals,

computers stocks,

computer stock,

computer web,

internet stocks,

construction stocks,

machinery stocks,

builders stocks,

building stocks,

consumer goods stocks,

consumer services stocks,

consumer services companies,

lending stocks,

mortgage banking,

lending companies,

mortgage bankers,

loan services,

mortgage services,

mortgage bank,

loan bank,

defense stocks,

defensive stock,

department store stocks,

diagnostic company,

diagnostic companies,

pharmaceuticals stocks,

drug stocks,

drug company stocks,

pharma stock,

education stocks,

college stock,

electric utility stocks,

electric company stocks,

electric utilities stocks,

utility stocks,

utilities stocks,

power equipment companies,

electrical supply companies,

electronic stocks,

entertainment stock,

movie stocks,

movies companies,

movie company,

cefs,

open ended and closed ended mutual funds,

closed ended investment,

closed ended fund,

bonds fund,

closed end,

food stock,

game stock,

gambling stocks,

casino stocks,

gaming stocks list,

gaming stocks,

gas utility companies,

gas company stocks,

construction industries,

builders contractors,

construction services,

construction industry,

grocery store stocks,

supermarket stock,

drug store stocks,

home stocks,

furniture stock,

home improvement stocks,

medical company stocks,

top medical stocks,

medical stock,

hospital stock,

medical supply stocks,

medical technology stocks,

medical device stocks,

medical equipment stocks,

copper mining,

palladium mining stocks,

mining metals,

mining,

mining news,

gold exploration,

mining share price,

lithium mines,

mining industries,

international mining companies,

mining information,

molybdenum mining companies,

nickel mining companies,

metals and mining stocks,

gold and silver mining stocks,

copper mining companies,

rare earth mining companies,

rare metals stocks,

rare earth stocks,

metals stocks,

welding stock,

nonprecious metals,

non metallic mining,

office supplies companies,

office supply companies,

oil services stocks,

oil pipeline stocks,

gas pipeline stocks,

gas pipeline companies,

pipeline companies,

natural gas pipeline companies,

oil services companies,

oil field services,

oil service stocks,

natural gas pipelines,

oilfield service companies,

oil and gas pipeline companies,

oil gas pipeline,

oil exploration stocks,

oil exploration sector,

oil exploration companies,

oil drilling stocks,

oil drilling companies,

oil production companies,

china oil companies,

brazil oil companies,

china oil stocks,

brazil oil stocks,

oil companies,

oil stocks,

oil drilling,

oil exploration,

offshore oil drilling companies,

list of oil drilling companies,

oil and gas exploration,

oil and gas drilling,

oil and gas stocks,

oil and gas drilling companies,

oil refining companies,

oil marketing companies,

oil refining stocks,

oil refining sector,

oil refinery companies,

oil refinery stocks,

major oil companies,

oil sector,

oil refinery,

oil refinery company,

oil company,

oil marketing company,

oil refining company,

oil refining industry,

major oil companies list,

oil and gas companies,

crude oil stocks,

packaging companies,

container companies,

packaging stocks,

packaging sector,

container sector,

pulp stocks,

paper stocks,

timber stocks,

pulp companies,

paper companies,

timber companies,

timber trusts,

cardboard companies,

paper sector,

timber sector,

paper companies list,

silver mining companies,

gold mining companies,

gold mining sector,

precious metal stocks,

mining companies,

exploration sector,

mining sector,

exploration stocks,

mining stocks,

silver stocks,

gold stocks,

gold mining stocks,

silver mining stocks,

silver mining company,

canadian mining companies,

gold mining,

gold mining company,

mining company,

list of mining companies,

gold stocks list,

largest gold mining companies,

silver mining,

printing companies,

printing stocks,

printing sector,

newspaper stocks,

newspaper sector,

newspaper companies,

publishing stocks,

publishing sector,

publishing companies,

digital media companies,

digital media stocks,

digital media sector,

book publishing companies,

digital media company,

publishing company,

railroad stocks,

railroad sector,

railroad companies,

railroad company,

railroad investment,

major railroad companies,

real estate companies,

real estate stock,

real estate public companies,

real estate investing,

real estate investments,

real estate sector,

commercial real estate investing,

real estate investment firms,

real estate investing guide,

REITs,

real estate investment trust,

REIT sector,

REIT stocks,

REITs sector,

REITs stock,

public REITs,

real estate investment trusts,

real estate investment trust companies,

real estate investment trusts REITs,

real estate investment companies,

real estate investment company,

real estate investment trust REIT,

rubber stocks,

plastic stocks,

rubber companies,

plastic companies,

rubber sector,

plastic sector,

plastic manufacturing companies,

rubber company,

plastic company,

semiconductor stocks,

semiconductor investments,

semi stocks,

semiconductor companies,

semiconductor sector,

shipping stocks,

dry bulk stocks,

container stocks,

dry bulk shipping,

dry bulk shipping companies,

tanker stocks,

shipping companies,

shipping sector,

specialty retail,

retail stocks,

retail investing,

retail store stocks,

consumer stocks,

consumer investment,

retail companies,

retail sector,

sports stocks,

sports investing,

sporting goods stocks,

sports investments,

sporting goods companies,

sporting goods sector,

stock message boards,

television stocks,

television investment,

radio stocks,

radio invest,

media stocks,

media invest,

media investment,

media investing,

television companies,

television sector,

radio sector,

radio companies,

media companies,

media sector,

textile stocks,

apparel stocks,

textile investment,

textile companies,

textile sector,

apparel sector,

freight investment,

transportation investment,

truck investment ,

freight stocks,

transportation stocks,

trucking stocks,

trucking companies,

trucking sector,

waste management stocks,

waste stocks,

recycling stocks,

waste investment,

waste companies,

waste sector,

water stocks,

water utilities,

water investing,

water investment,

water companies,

water sector

MONTREAL, Jan. 10, 2024 (GLOBE NEWSWIRE) -- HPQ Silicon Inc. ("HPQ" or the "Company") (TSX-V: HPQ) (OTCQB: HPQFF) (FRA: O08), a technology company specializing in green engineering processes for silica and silicon material production is pleased to announce the completion of an internal technical and economic study (the "Study") related to its proprietary Fumed Silica Reactor technology. The study was prompted by an inquiry from a participant in the Fumed Silica industry under NDA. The study assessed the technical and economic viability of quickly scaling up the HPQ Silica Polvere's Fumed Silica Reactor (FSR) from the current 50 tonnes per year (TPY) pilot plant configuration to a 1,000 TPY commercial configuration, following the successful completion of the pilot plant testing phase. The significance of this preliminary assessment lies in its confirmation of the technical feasibility of rapid scaling up to a 1,000 TPY FRS [1] while preserving the best-in-class environmental advantages inherent in the FSR technology [2]. Moreover, the study unveiled its robust economic potential, emphasizing potential EBITDA margins three times higher than the industry average of 20% [3] and a capital investment 93% less than that required for building a conventional Fumed Silica plant [4]. "The shift of interest in our Fumed Silica offering, from the initial signing of our first NDA to explore the material commercial potential to a current keen focus on the commercial scalability potential of our proprietary Fumed Silica Reactor technology, marks another major step forward for HPQ Silica Polvere," said Mr. Bernard Tourillon, President and CEO of HPQ Silica Polvere Inc. and HPQ Silicon Inc. IMPLEMENTING AN INCREMENTAL COMMERCIALISATION STRATEGY FOR HPQ POLVERE FUMED SILICA To meet the anticipated demand for low carbon fumed silica materials, HPQ Polvere commercialisation strategy is based on building a 1,000 tonnes per year (TPY) Fumed Silica Reactor and scaling up capacity to meet demand with an additional 1,000 TPY Fumed Silica Reactor. To prepare the internal economic study, HPQ Polvere management used technology provider and equipment supplier PyroGenesis Canada Inc. (TSX: PYR) (OTCQX: PYRGF) (FRA: 8PY) (PyroGenesis) rough order of magnitude study regarding the cost of building the first 1,000 tonnes per year (TPY) Fumed Silica Reactor. HPQ management then used selling prices for the Fumed Silica and potential operating costs from information derived from third party sources and publicly available data. The salient points of the internal economic study indicate that the HPQ Fumed Silica Reactor will have:

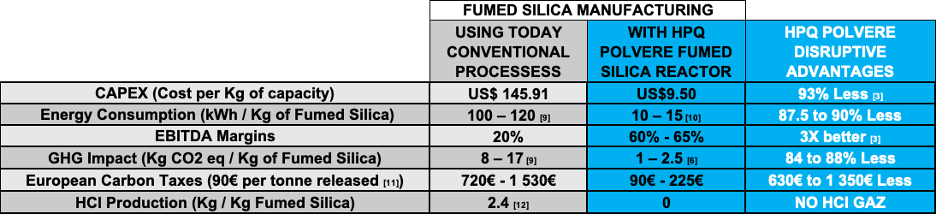

"HPQ Silica is uniquely positioned to be the sole provider capable of supplying the materials required to meet the increasing demand for low carbon Fumed Silica products," added Mr. Tourillon. "This demand is anticipated to necessitate the deployment of numerous 1,000 TPY Fumed Silica Reactors in the future." While HPQ Polvere technology is the only ultra–low carbon footprint process, no green premium was used when calculated the selling price of the material used for the internal economic study. HPQ POLVERE DISRUPTIVE ADVANTAGES IN ONE TABLE

"This table clearly shows that HPQ Polvere Fumed Silica Reactor (FSR) has many disruptive advantages that can threaten traditional Fumed Silica Manufacturing and can be a significant opportunity for HPQ and its shareholders," continued Mr. Tourillon. HPQ management plans to update and further validate these projections when more data is collected from an upcoming pilot plant testing phase later in the year. This will be achieved with the completion of an engineering cost and feasibility study that will be conducted by an independent party at the appropriate time. REFERENCE SOURCES

There can be no assurance that the economic projections upon which this Study is founded will be realized. Not limited to the viability of mass production scale-up, product optimization, financial considerations, and macroeconomic and environmental factors, several risks and uncertainties are inherently associated with any nascent technology commercialization. The Study is intended to be comprehended as a cohesive whole, and individual sections should not be interpreted or relied upon in isolation or without the accompanying context. Readers are duly advised to consider all assumptions, limitations, and exclusions that pertain to the information provided in the Study." About PyroGenesis Canada Inc. PyroGenesis Canada Inc., a high-tech company, is a leader in the design, development, manufacture and commercialization of advanced plasma processes and sustainable solutions which reduce greenhouse gases (GHG) and are economically attractive alternatives to conventional "dirty" processes. PyroGenesis has created proprietary, patented, and advanced plasma technologies that are being vetted and adopted by multiple multibillion dollar industry leaders in three massive markets: iron ore pelletization, aluminum, waste management, and additive manufacturing. With a team of experienced engineers, scientists and technicians working out of its Montreal office, and its 3,800 m2 and 2,940 m2 R&D and manufacturing facilities, PyroGenesis maintains its competitive advantage by remaining at the forefront of technology development and commercialization. The operations are ISO 9001:2015 and AS9100D certified, having been ISO certified since 1997. For more information, please visit: www.pyrogenesis.com About HPQ Silicon HPQ Silicon Inc. (TSX-V: HPQ) is a Quebec-based TSX Venture Exchange Tier 1 Industrial Issuer. HPQ is developing, with the support of world-class technology partners PyroGenesis Canada Inc. and NOVACIUM SAS, new green processes crucial to make the critical materials needed to reach net zero emissions. HPQ activities are centred around the following four (4) pillars:

For more information, please visit HPQ Silicon web site. Disclaimers: This press release contains certain forward-looking statements, including, without limitation, statements containing the words "may", "plan", "will", "estimate", "continue", "anticipate", "intend", "expect", "in the process" and other similar expressions which constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking statements reflect the Company's current expectation and assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company's ongoing filings with the security's regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release is available on the company's CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders. Source: HPQ Silicon Inc. For further information contact: Bernard J. Tourillon, Chairman, President, and CEO Tel +1 (514) 846-3271 A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7e4b613c-edf1-49e1-ac95-fe15c9d6a737

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||